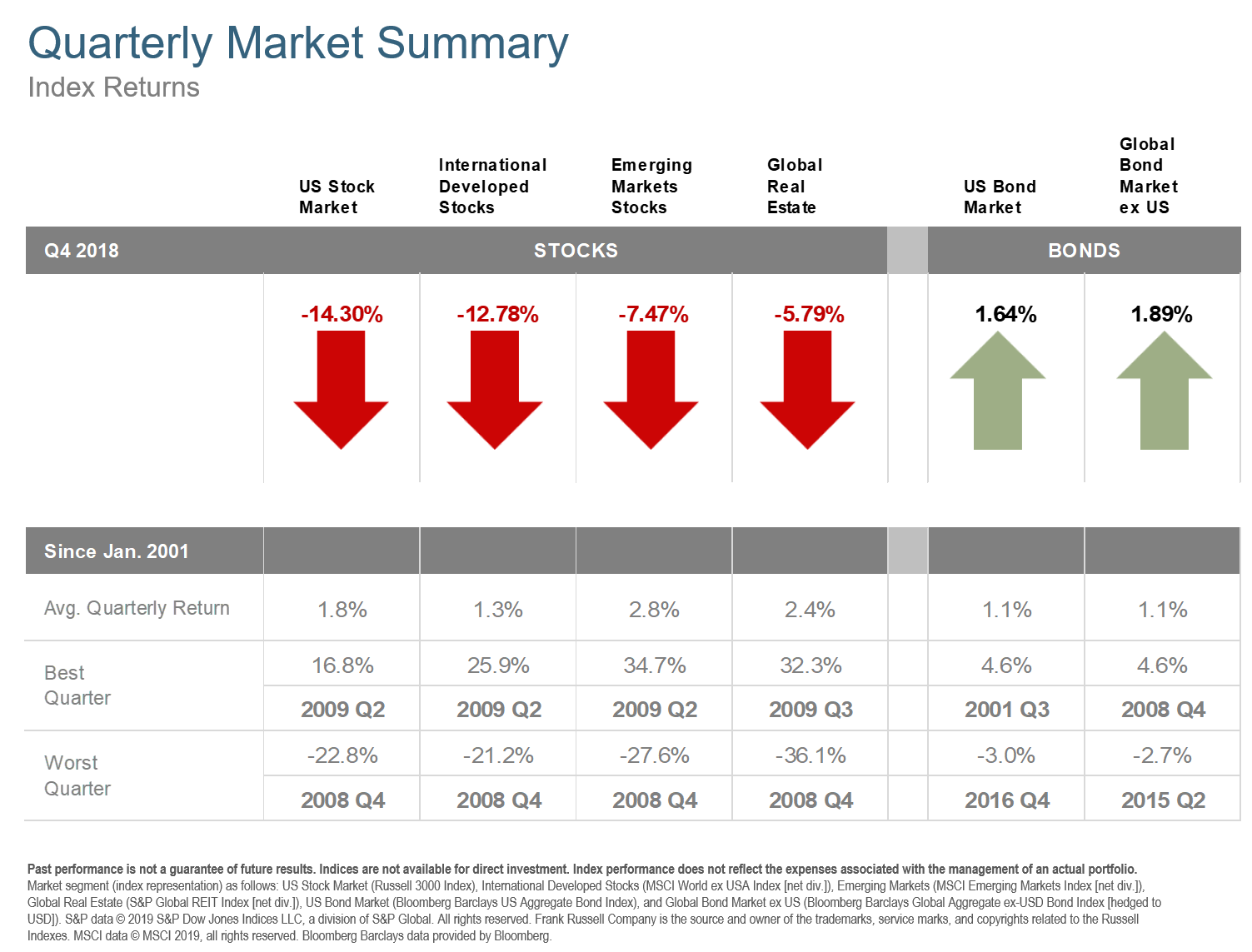

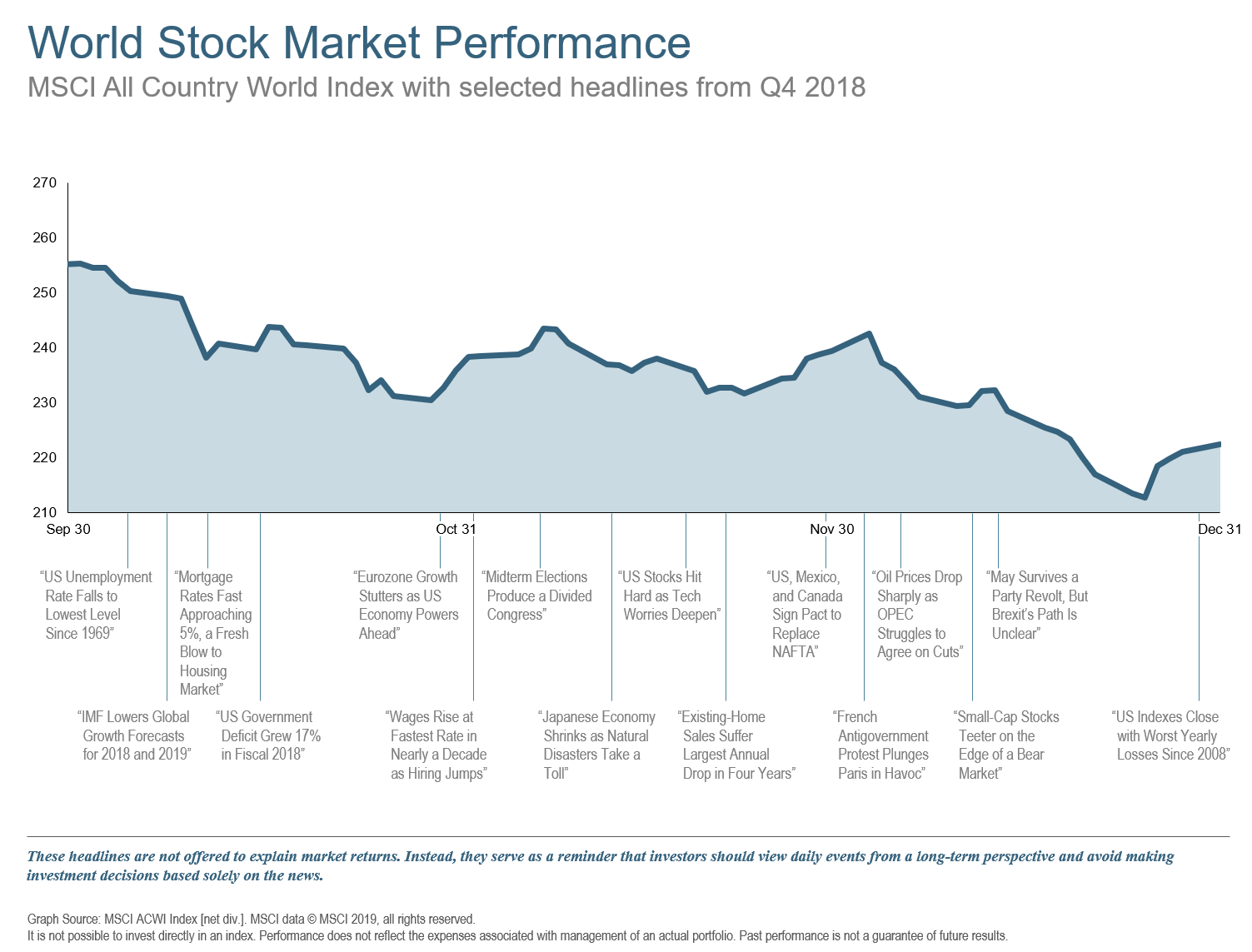

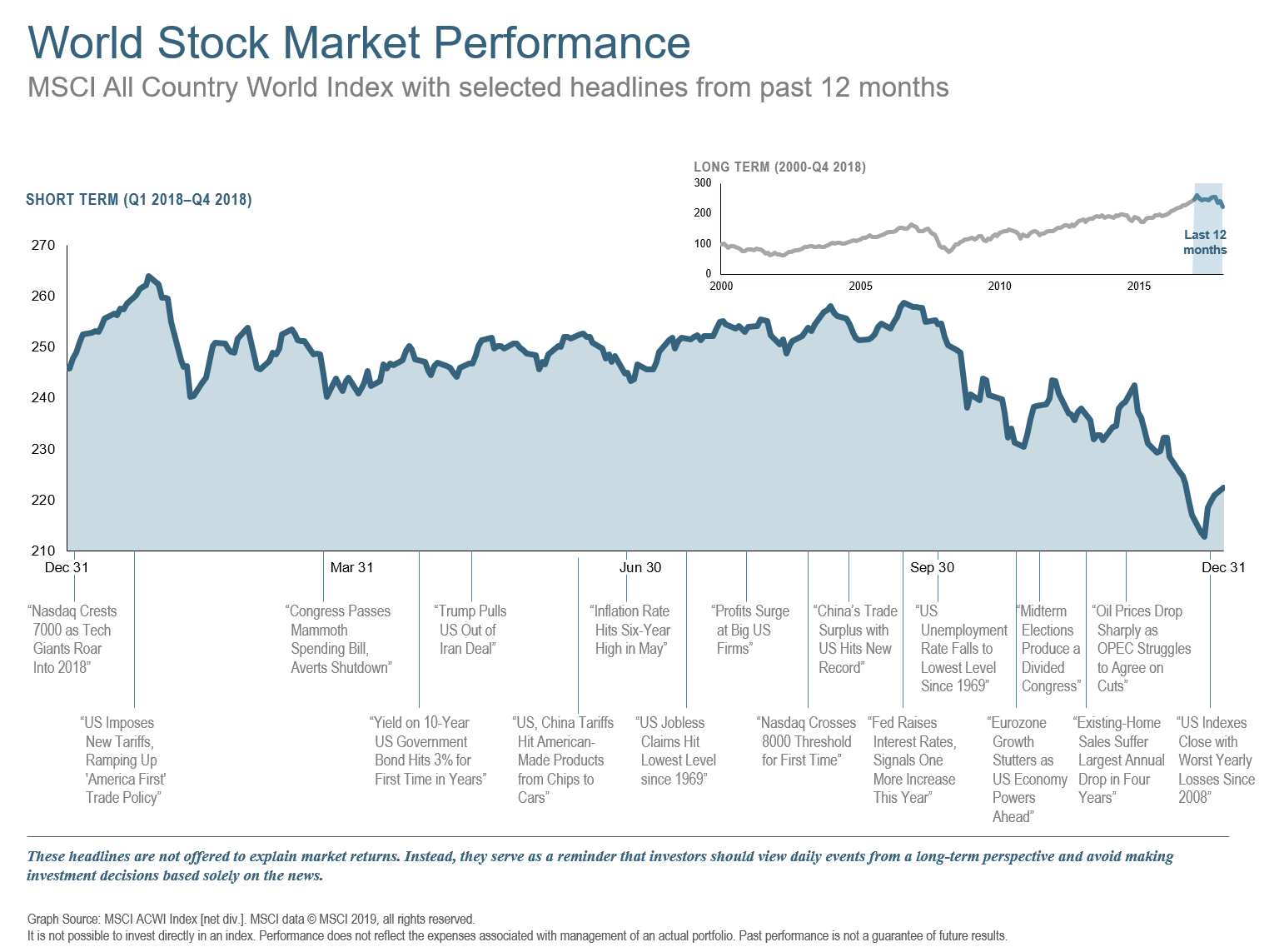

Happy New Year! As for the last one, at least the last quarter, good riddance! Concerns that the Fed may have applied the brakes a tad too long, an escalating trade war with China, a mid-term shakeup in Washington DC, ongoing Brexit drama, and a eurozone confidence slowdown resulted in the worst quarter for equity markets since the 2008-09 bear market. The selloff really got going when the Fed Chairman suggested that further rate increases were on the horizon. That sparked volatility that ultimately saw equity markets fall to around 20% below previous highs, which is the classic definition of a bear market.

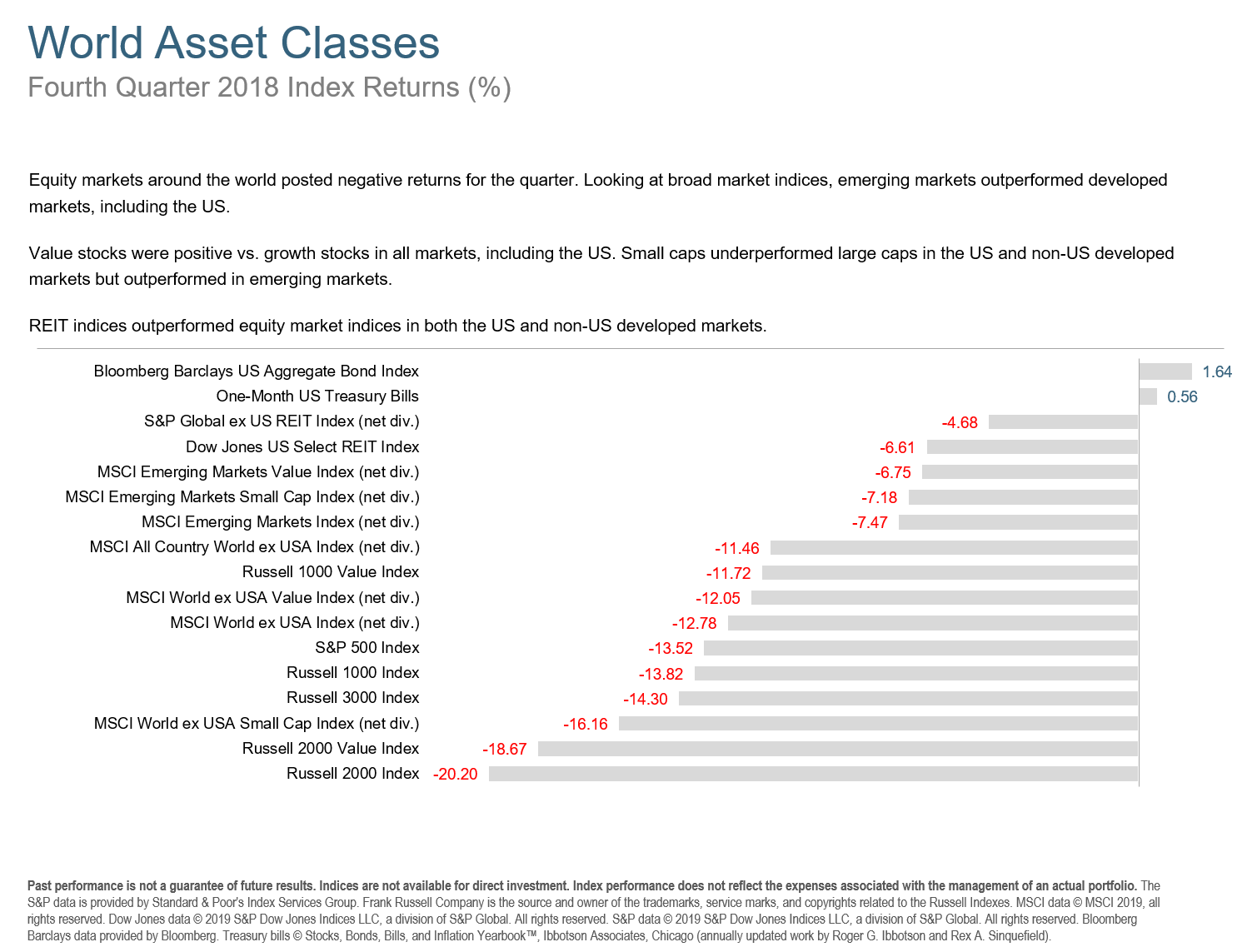

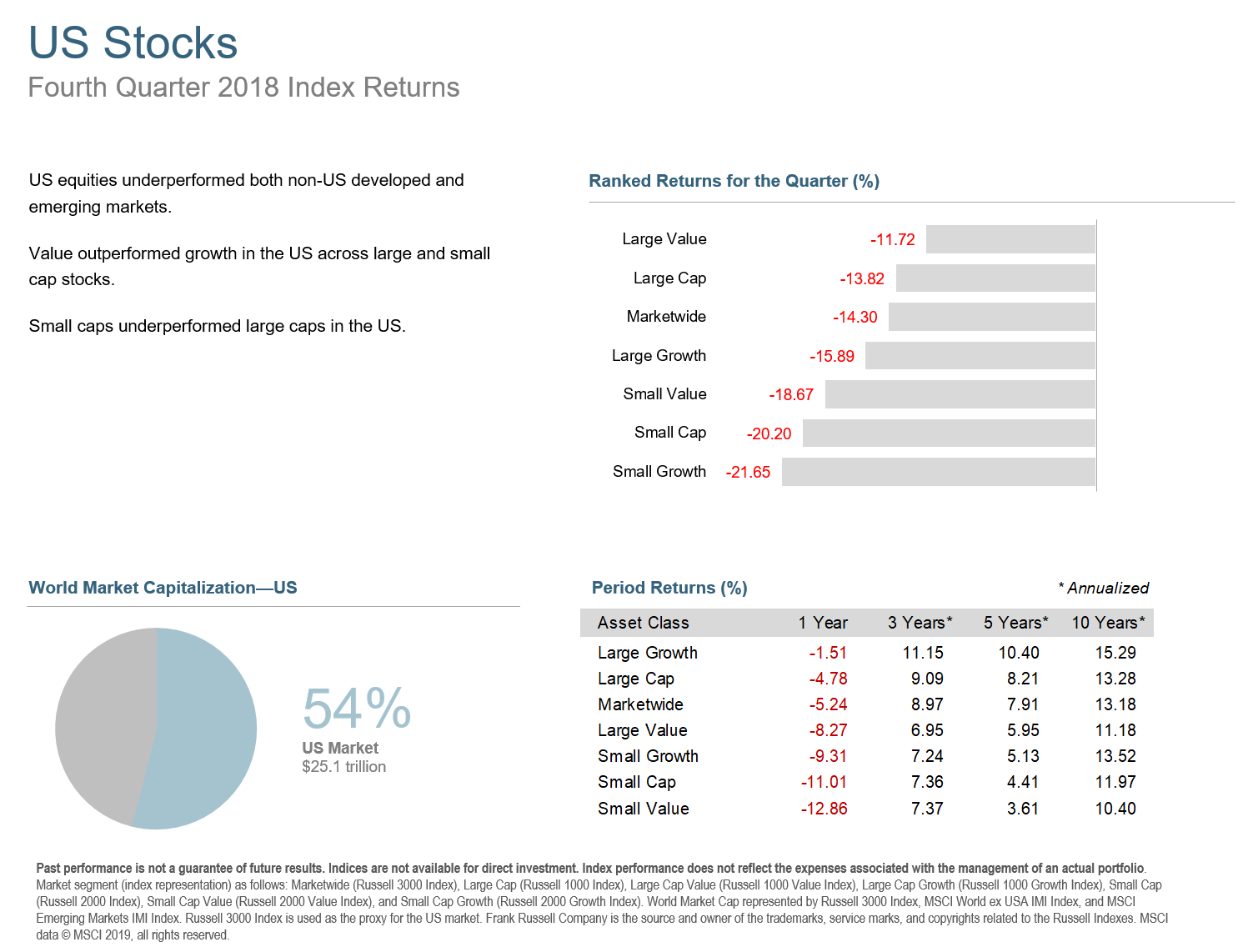

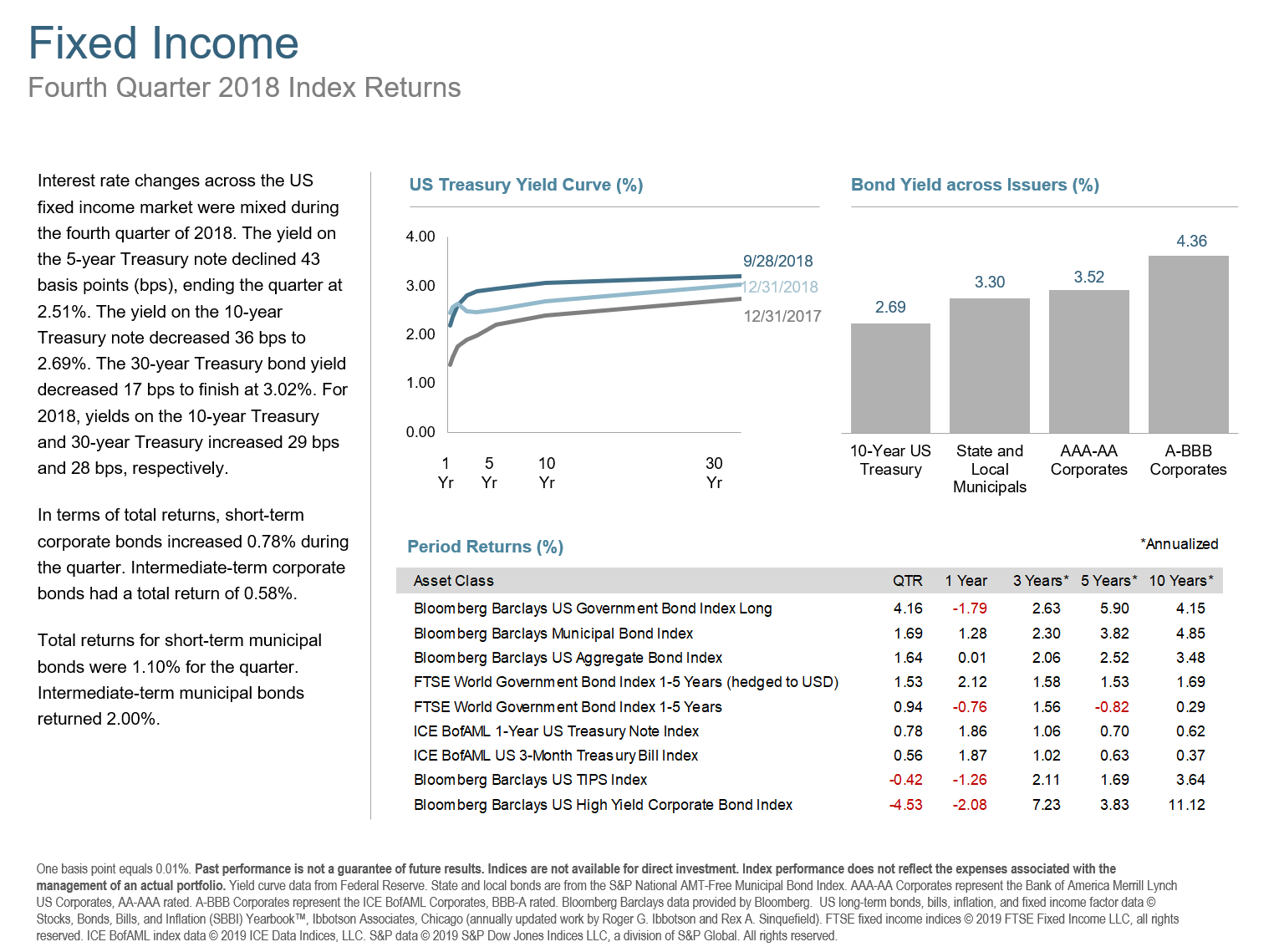

US large company growth stocks were the big losers of the quarter, but every equity category saw red. As tariffs were implemented against some Chinese goods, and China replied in-kind, our President proclaimed that he is “A Tariff Man” while threatening even more increases. Whether the US or China emerge as a winner of this trade war remains to be seen, but markets around the world rise and fall seemingly on every detail that leaks about the ongoing negotiations. In December, the Fed raised rates for the ninth time in three years and the fourth time in 2018. They appeared to be poised to continue on that path for the foreseeable future when Fed Chairman Jerome Powell proclaimed, “We’re a long way from neutral…”.

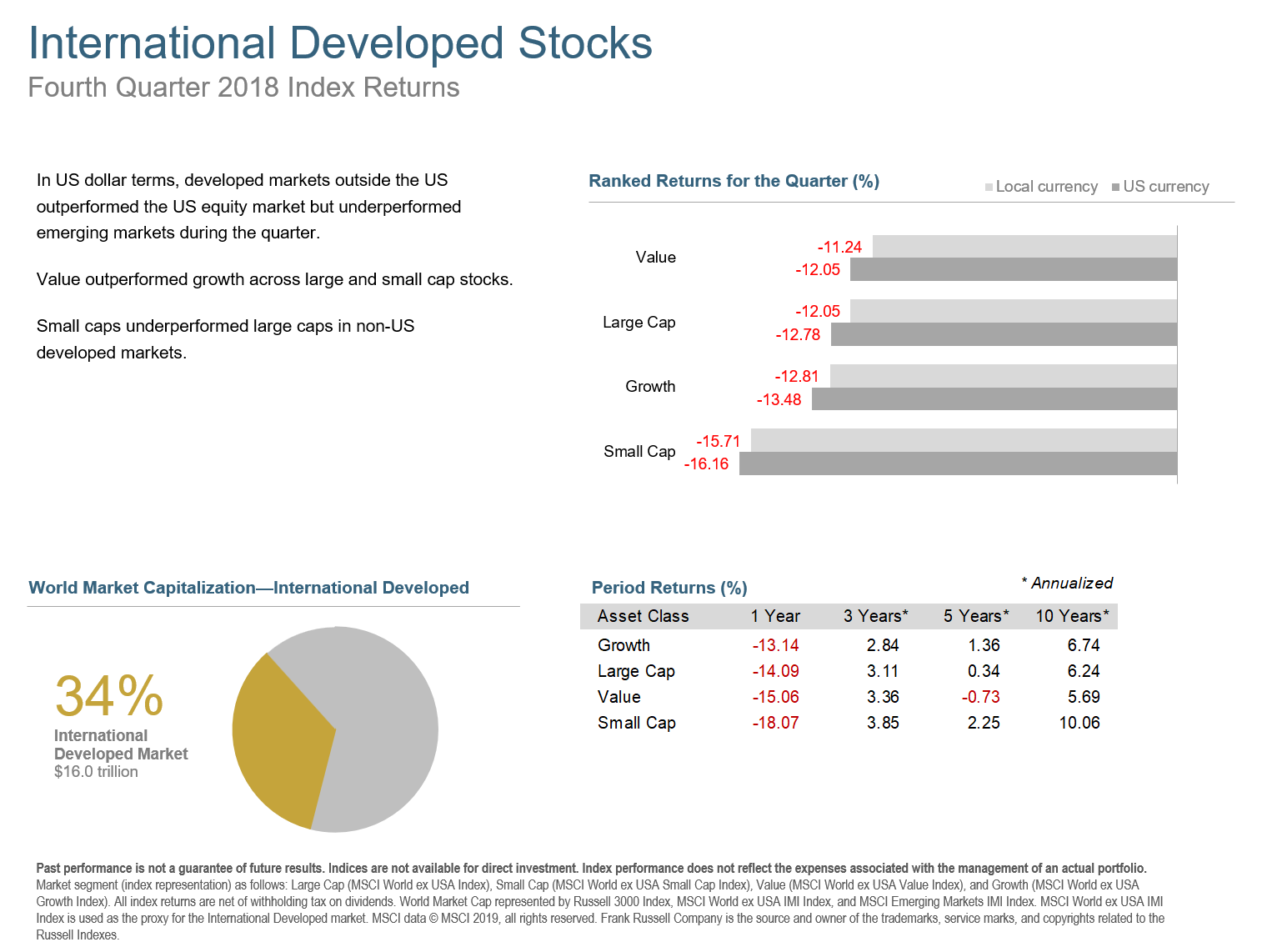

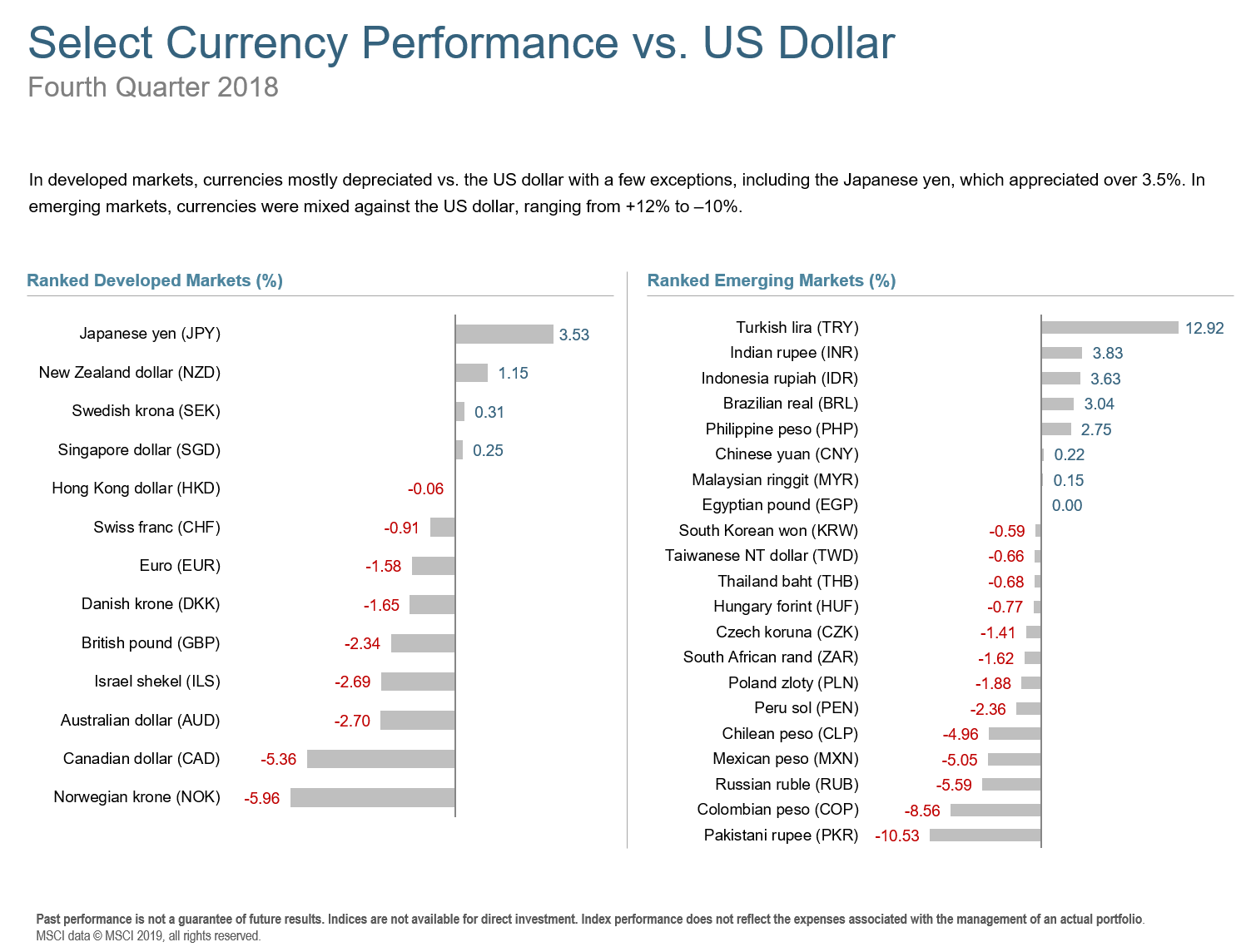

International equity markets may have slightly out-performed the US in Q4, but were still down by double digits. Not only has the trade war had a negative impact in many markets, but a showdown over spending between Italy and the EU, political unrest in France, and the end of quantitative easing by the European Central Bank have roiled many developed markets. Added uncertainty about how the UK’s exit from the EU (aka Brexit) will play out has also weighed on business and consumer confidence.

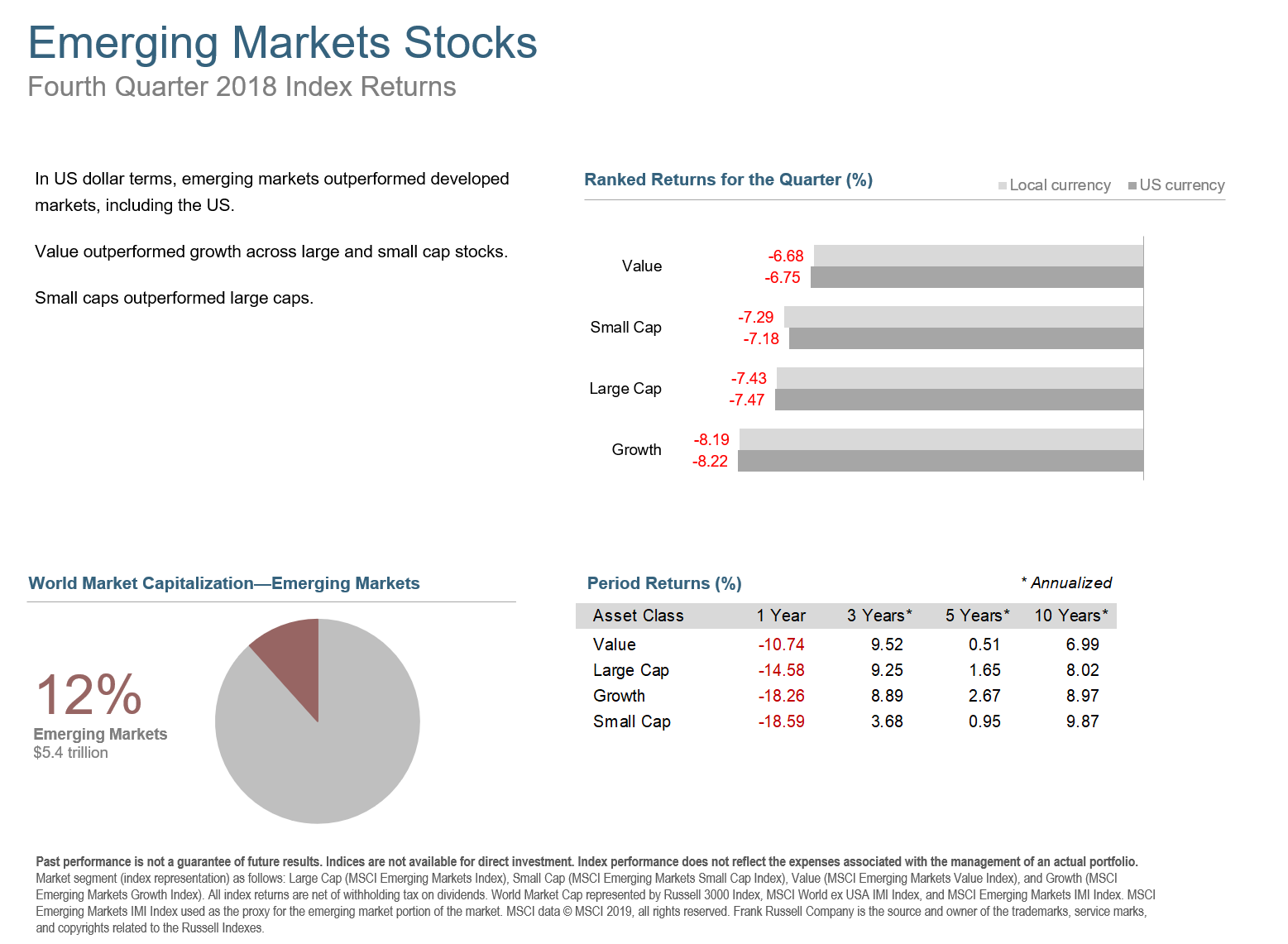

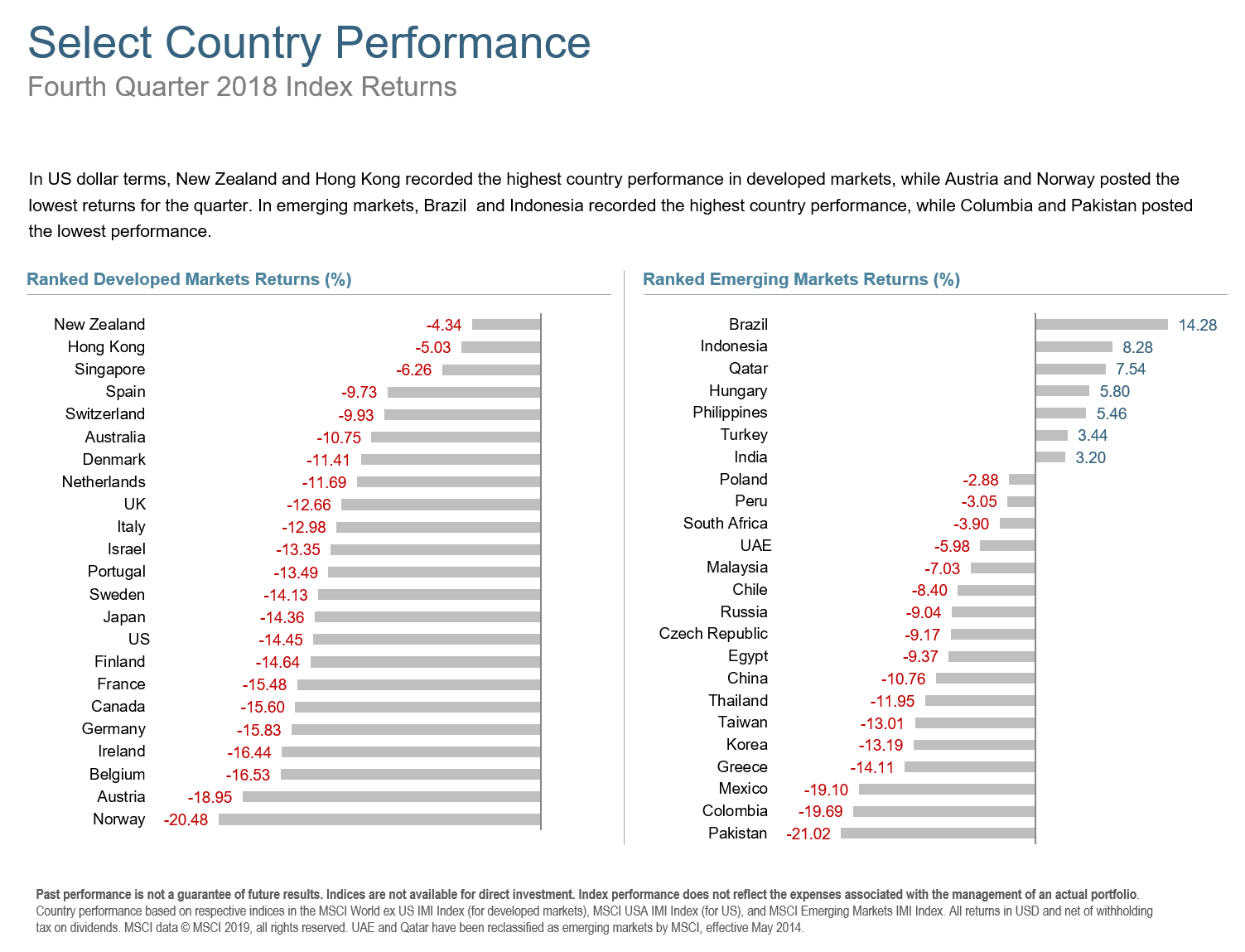

Emerging markets were relatively better in Q4, although they also were negative. China and several other Southeast Asian markets seemed to be most impacted by the trade war while Brazil and Turkey showed positive returns for the quarter.

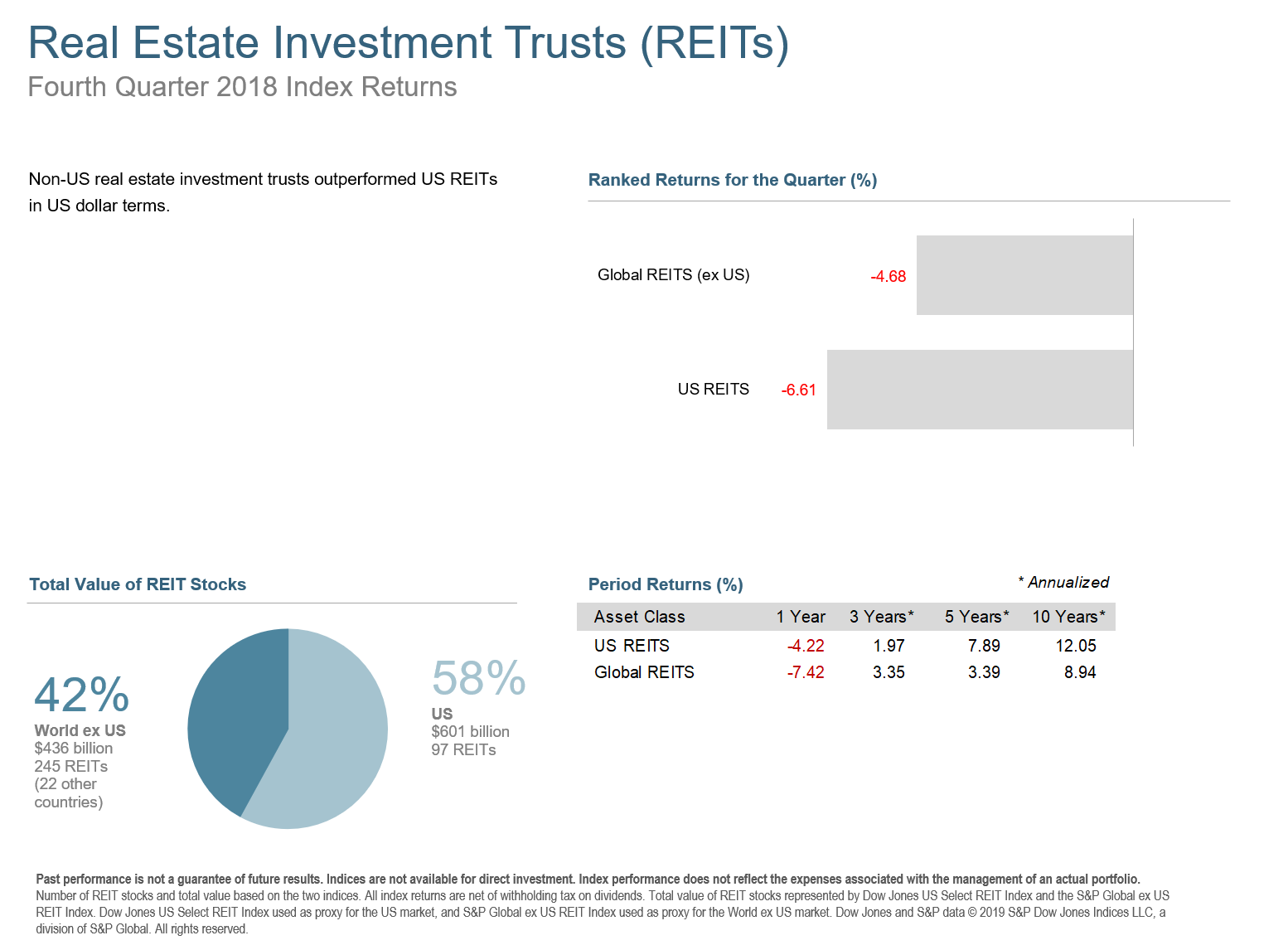

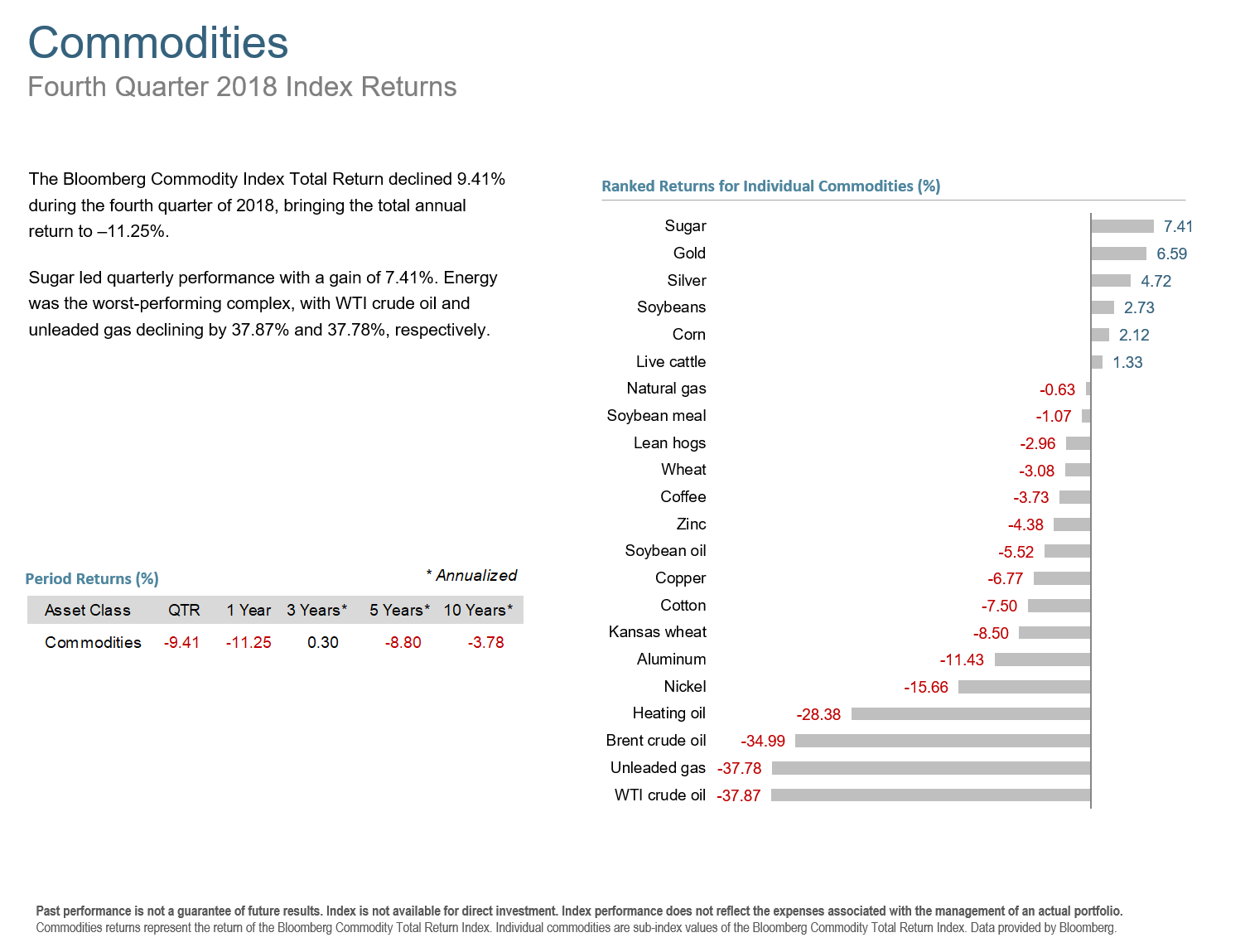

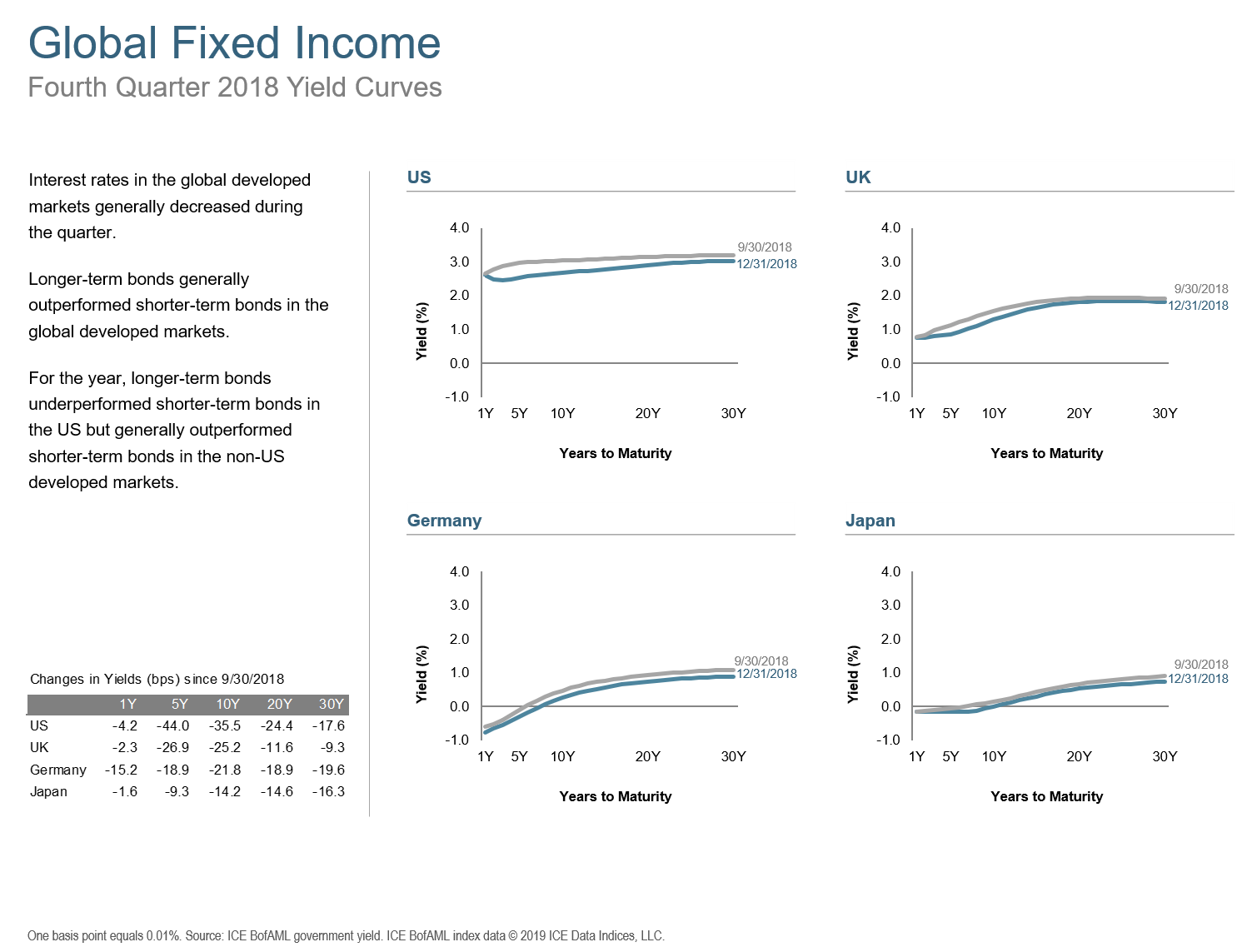

Bonds, in spite of rising rates, were the big winner as investors sought out shelter from the stock market storm. REITs and commodities were mostly negative, though gold and silver seemed to benefit from the market volatility.

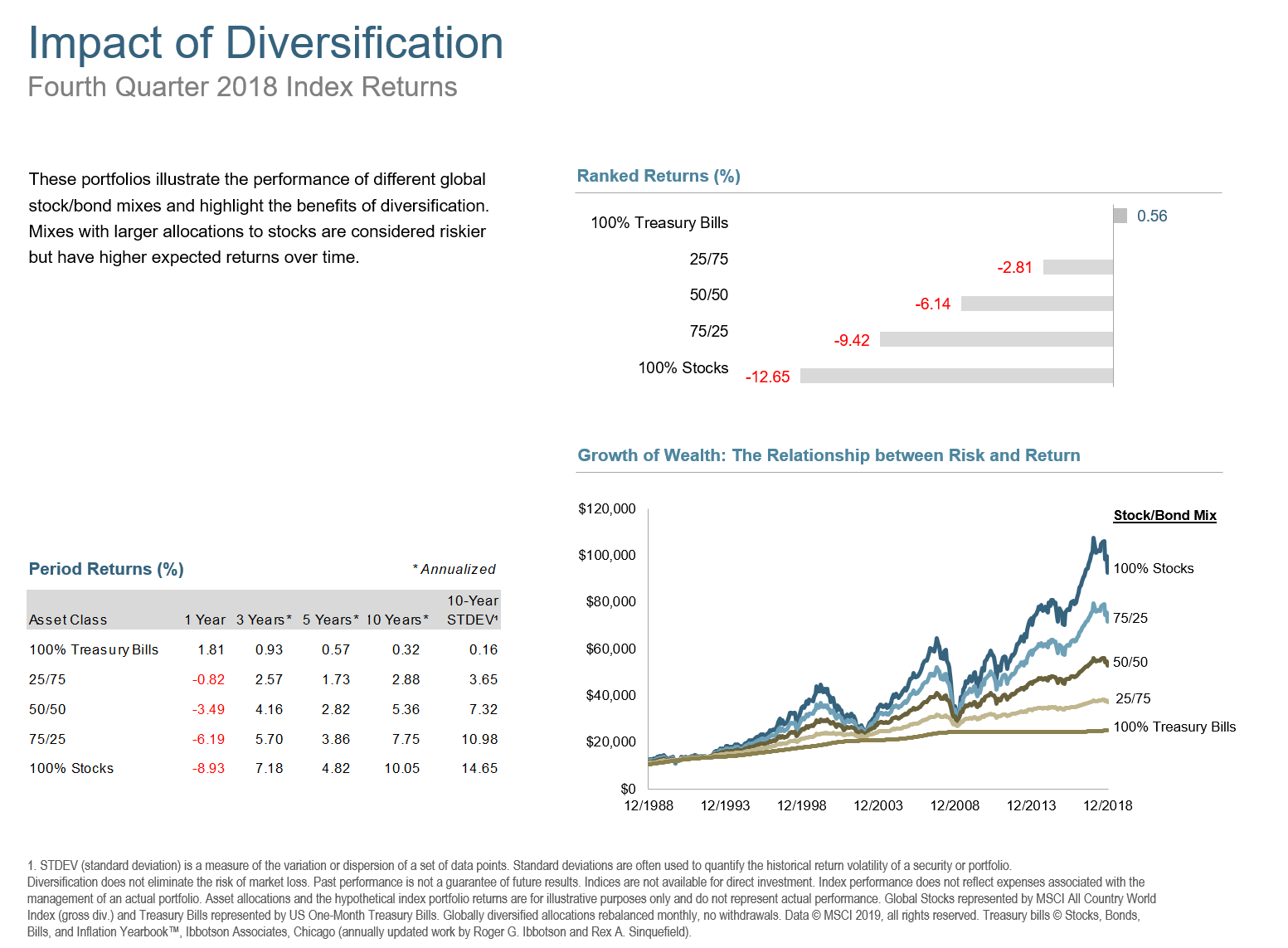

Investors are understandably concerned about these recent events and it can be challenging to resist the urge to flee when markets go down. It is normal to feel some remorse as we look at our balances today versus where they were just a few months ago but it is also worth remembering that the reason those balances grew to where they were is because investors are rewarded for taking risks. Unfortunately, in order to see our balances grow over time, we must accept that volatility is the ticket to participate. Tickets, like lunch, aren’t free.

If I have done my job, your portfolio is invested in such a way that you are able to ride out these dips without panicking. We do that by aligning your allocation to what we believe to be your tolerance for pain and invest those portions that may be needed in the near term in less volatile investments such as money markets and bonds. It may also help to remember that when we analyze your progress towards achieving your financial goals, we factor in negative periods such as we experienced in Q4, which provides us a better picture of where you stand.

Finally, we take a disciplined approach when a portfolio drifts away from its intended target allocation, buying into those areas that are most beaten down. In taxable accounts, we also have used the selloff as an opportunity to take some losses for tax purposes.

What I do not do is try to outguess what the market is going to do in the near term. We will stick with disciplined asset allocation based on our clients’ goals, risk tolerance, and risk capacity instead of trying to outmaneuver markets that are virtually impossible to outguess. I invest my own assets in exactly the same way as we manage those for our clients, and feel your pain when markets go down (and also by waiving our fees when you lose money during any month). We are always in this together.

The Q4 2018 Market Review features world capital market performance and a timeline of events for the past quarter. It begins with a global overview, then features the returns of stock and bond asset classes in the US and international markets.

As always, if current markets have you concerned about your portfolio, please get in touch for a review.

-Jeff