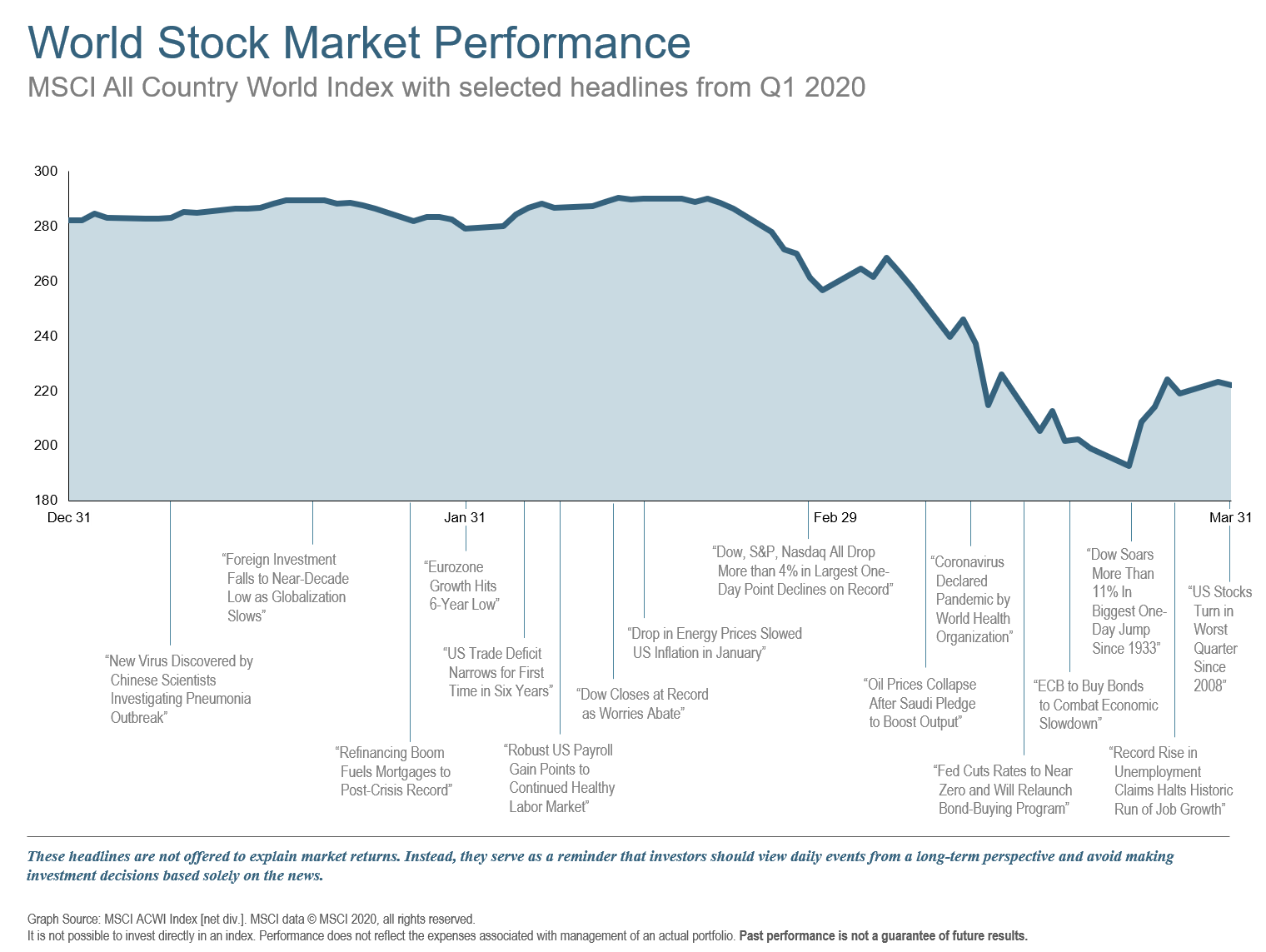

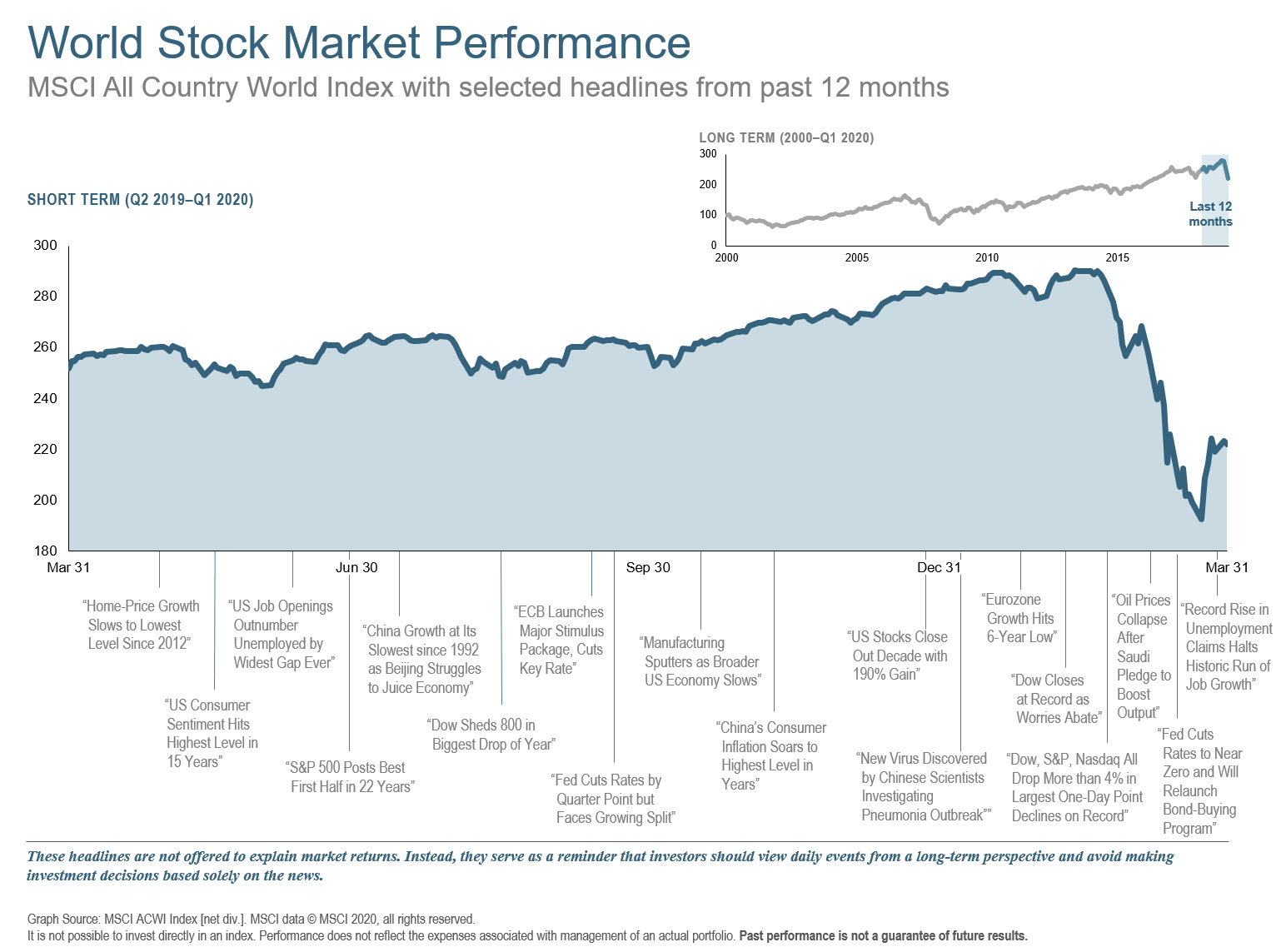

Apologies for being a few weeks later than normal with this Quarterly Market Review. My routine has been a little bit out of sorts for the last 6 weeks or so. The SARS-CoV-2 (a.k.a. Coronavirus, a.k.a. Covid-19) virus has been pretty impactful on all of us and world stock markets were no exception as whole economies locked down in an effort to contain the global pandemic.

The optimism resulting from the trade deal with China at the end of 2019 has been quickly replaced with fears of a depression caused by a bat from Wuhan. The Federal Reserve acted quickly by cutting interest rates twice in March, down to .25%. They also fired up the printing presses by beginning a new round of bond buying, known as quantitative easing. As jobless claims skyrocketed from around 220,000 per week in early March to 6,867,000 in the last week, the US Senate passed a $2 trillion stimulus package that included direct payments to households and loans to businesses.

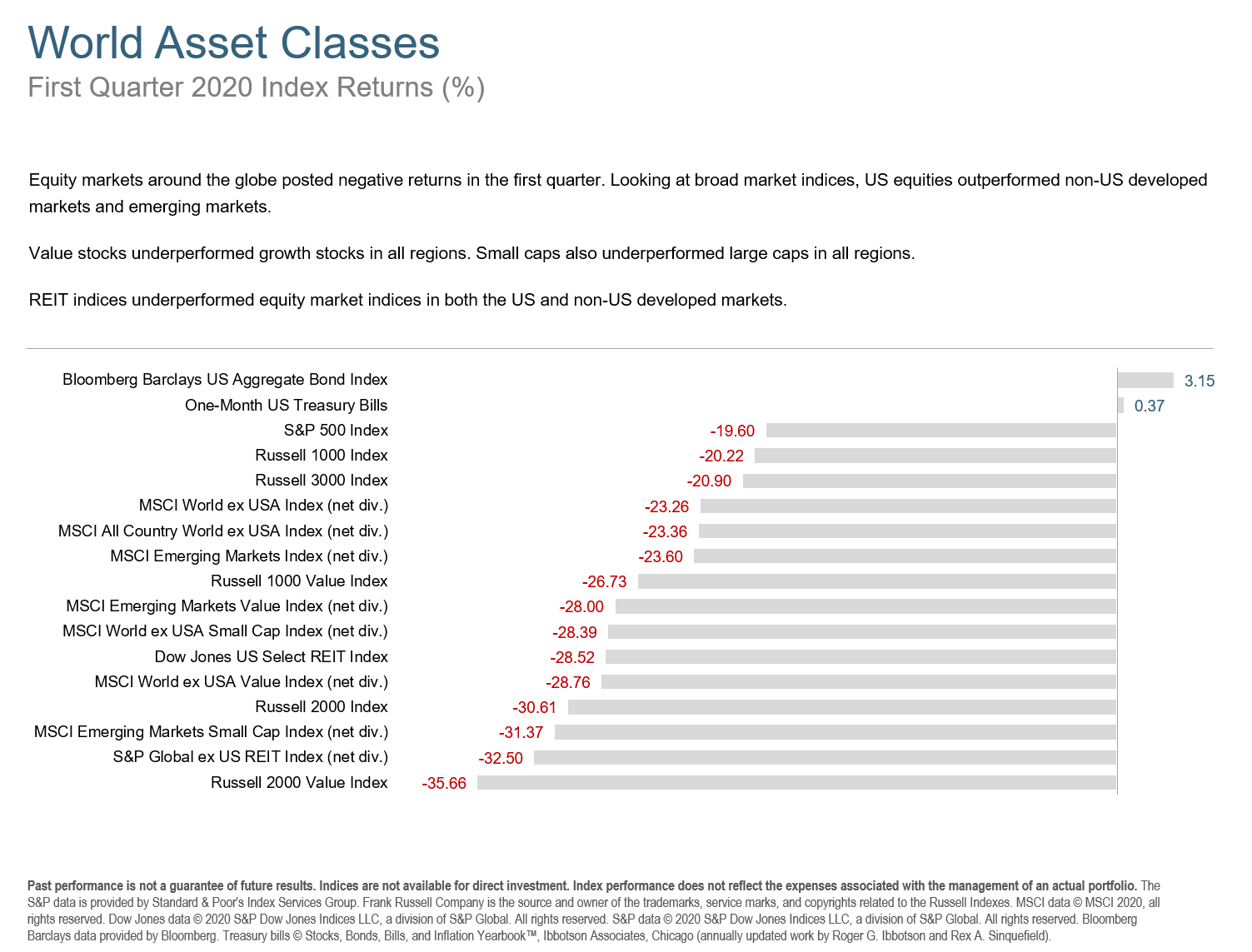

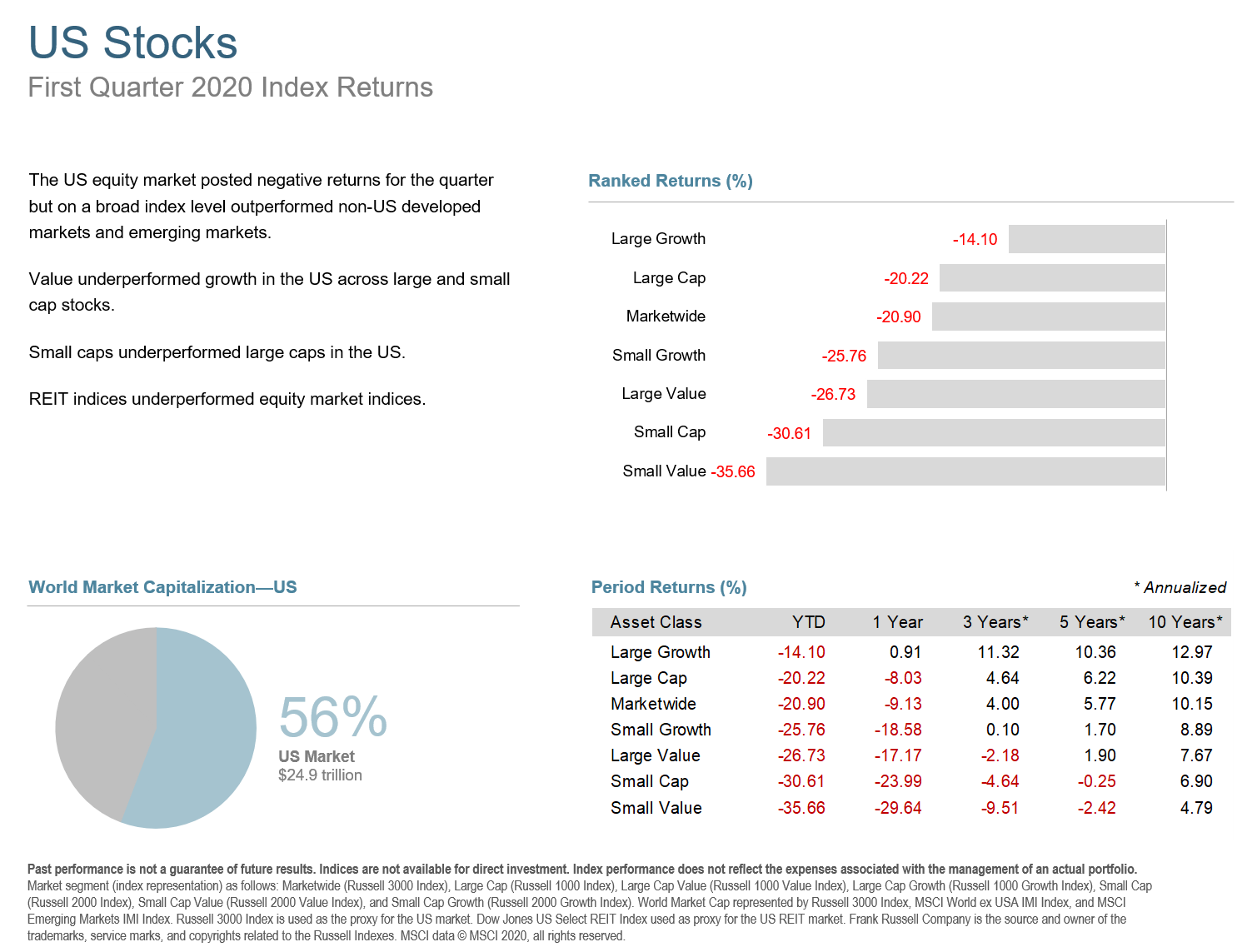

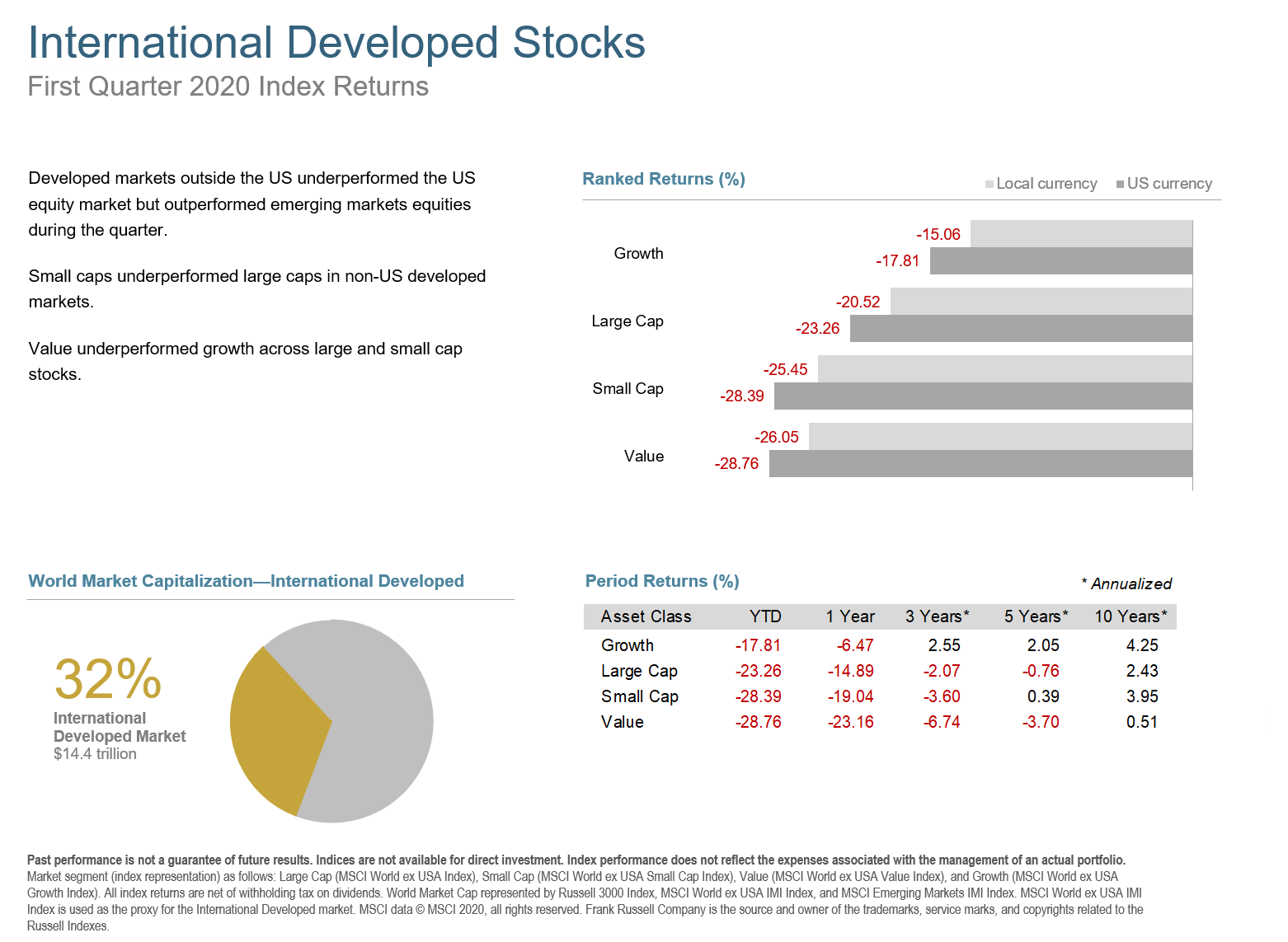

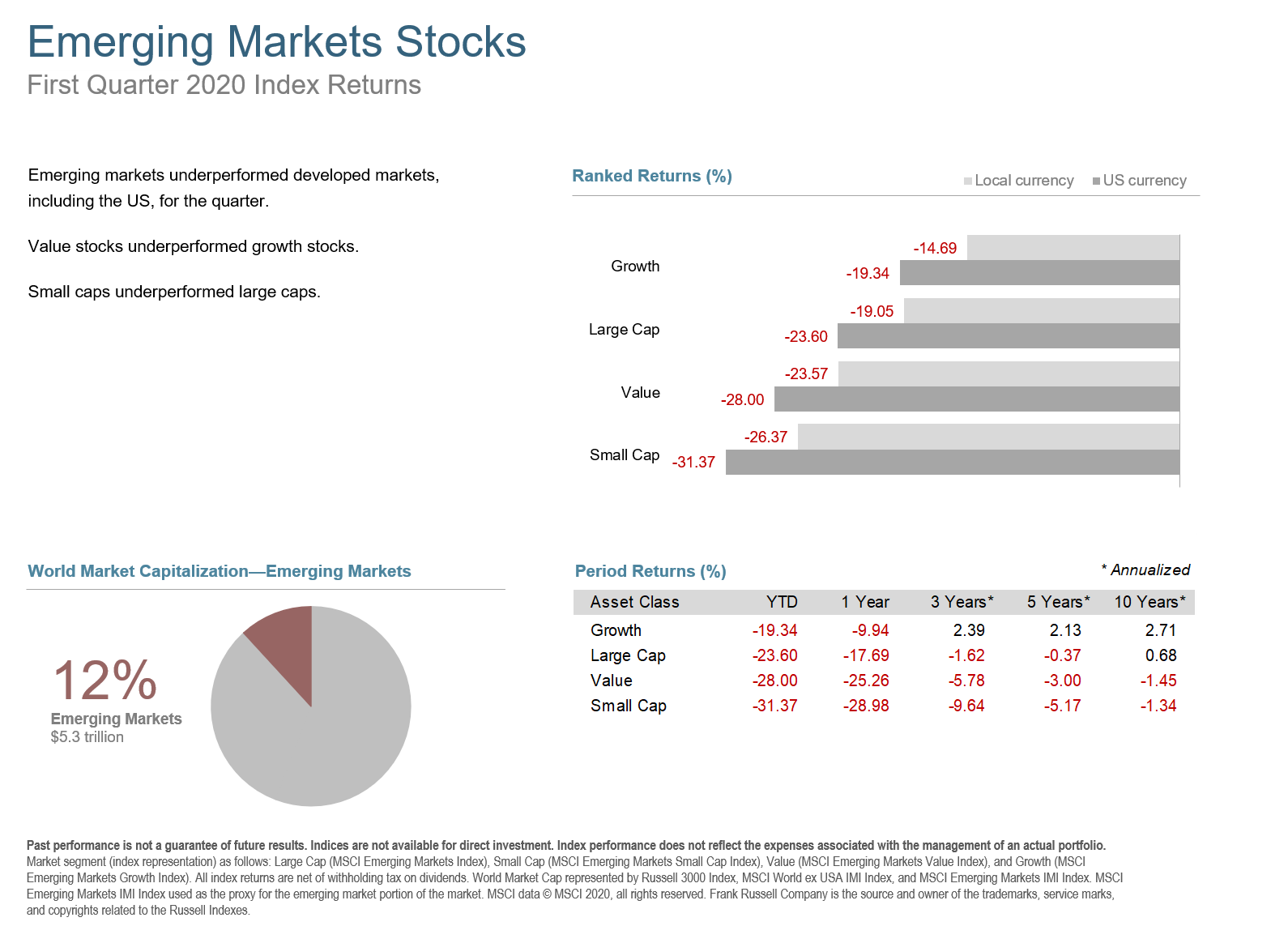

Equity markets around the globe suffered steep declines in Q1. Looking at broad market indices, US equities lost a little less than non-US developed and emerging markets during the quarter. Value stocks underperformed growth on a market wide basis in the US and in developed and emerging non-US markets. Small caps under-performed large caps in the US, developed non-US markets, and in emerging markets.

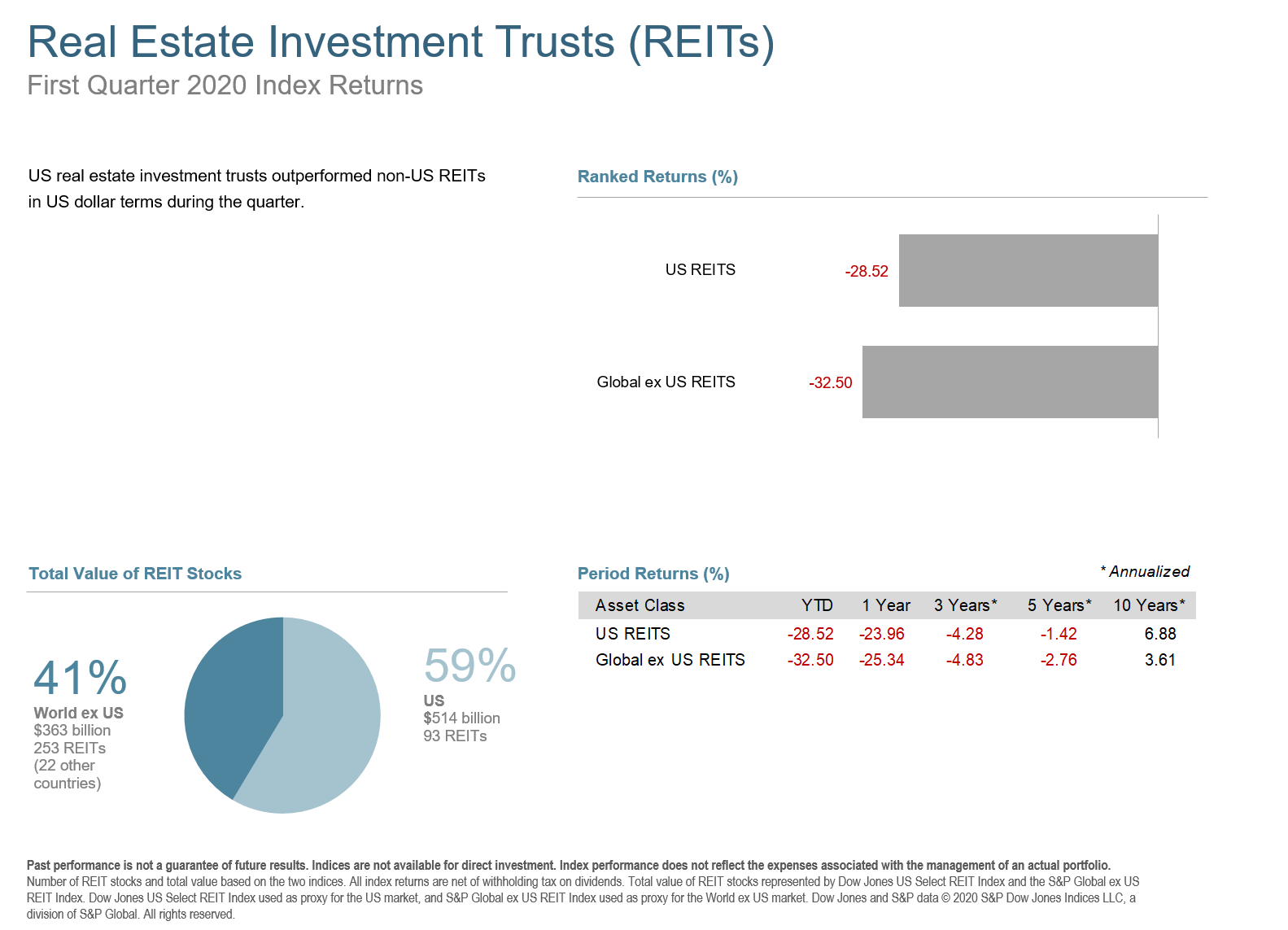

Real Estate Investment Trust (REIT) indices under-performed equity markets in both the US and non-US developed markets, with US REITs having a little better showing than the non-US.

US stocks didn’t fall quite as much as international developed and emerging markets equities, as the impacts of Covid-19 first appeared in Asia and Europe. In US dollar terms, emerging markets stocks underperformed developed non-US markets equities in Q1. Small caps under-performed large caps in non-US developed markets and in emerging markets. Growth stocks outperformed value across developed and emerging international large and small cap stocks.

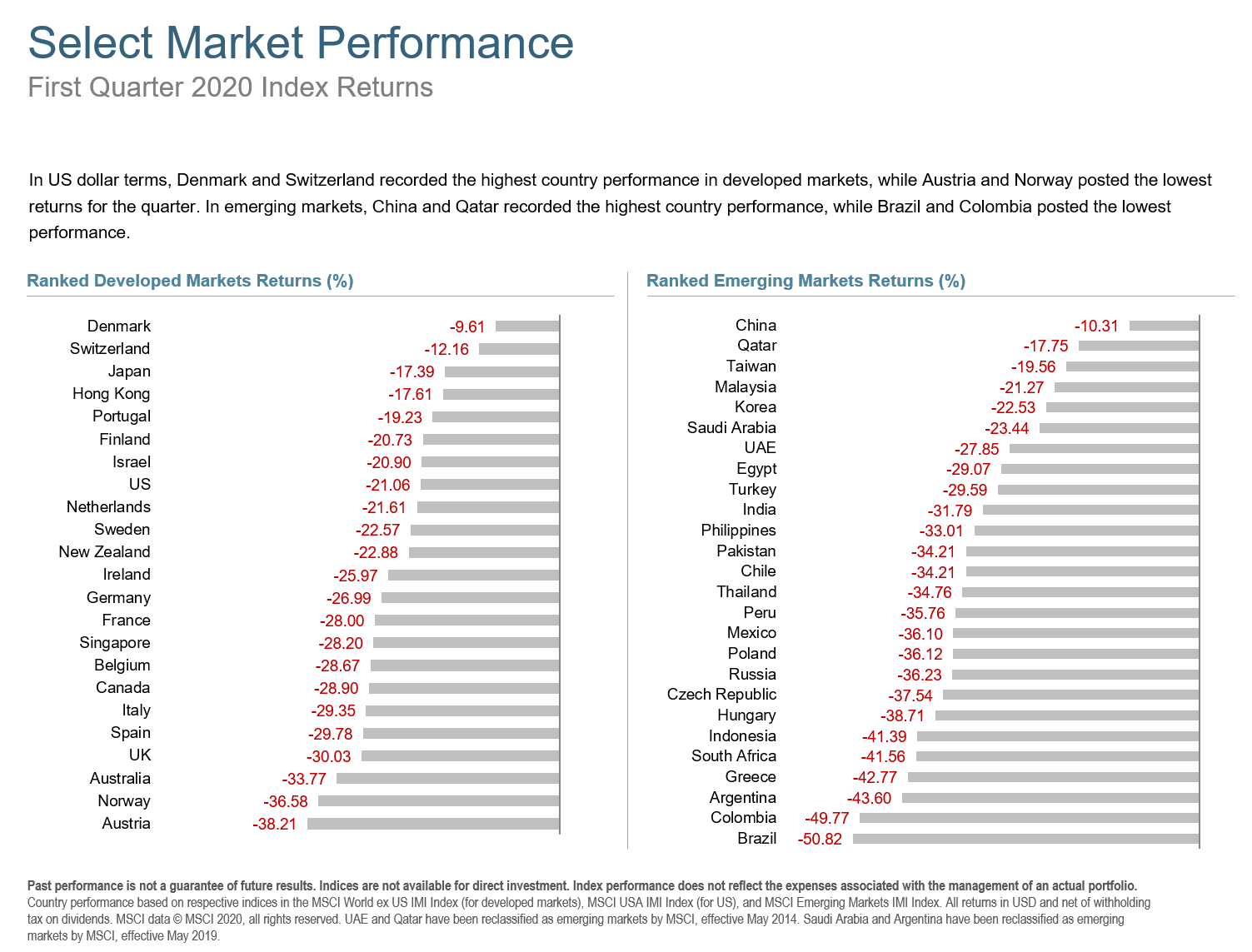

Every developed market was negative in Q1 but Denmark and Switzerland recorded the highest country performance while Norway and Austria posted the lowest returns for the quarter. Similarly, emerging markets were all negative. China recorded the best emerging market with a loss of 10.31%, while Brazil posted the lowest performance, declining 50.82%.

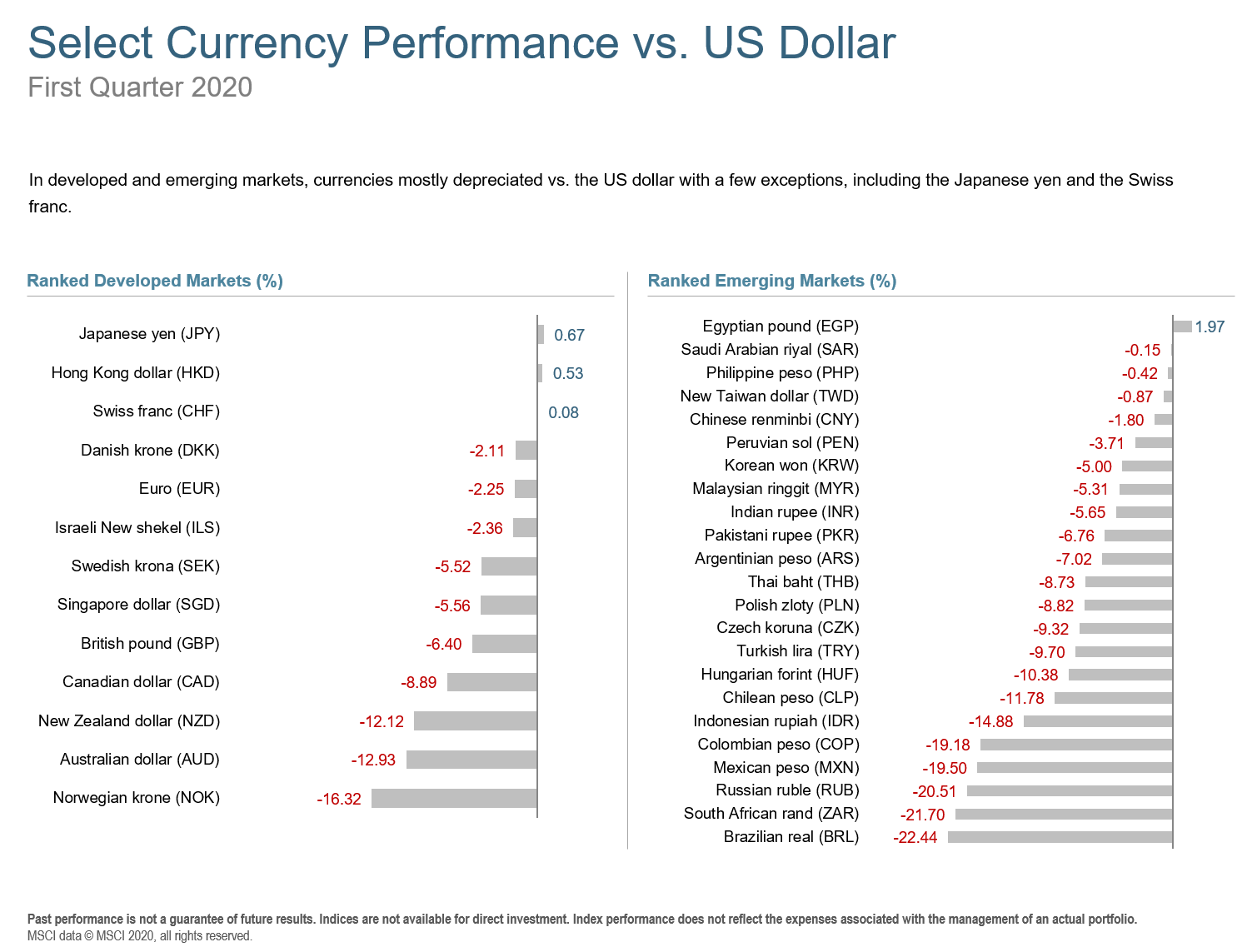

In both developed and emerging markets, most currencies were weaker against the US dollar. Exceptions were the Japanese Yen, Hong Kong Dollar, Swiss Franc, and Egyption Pound.

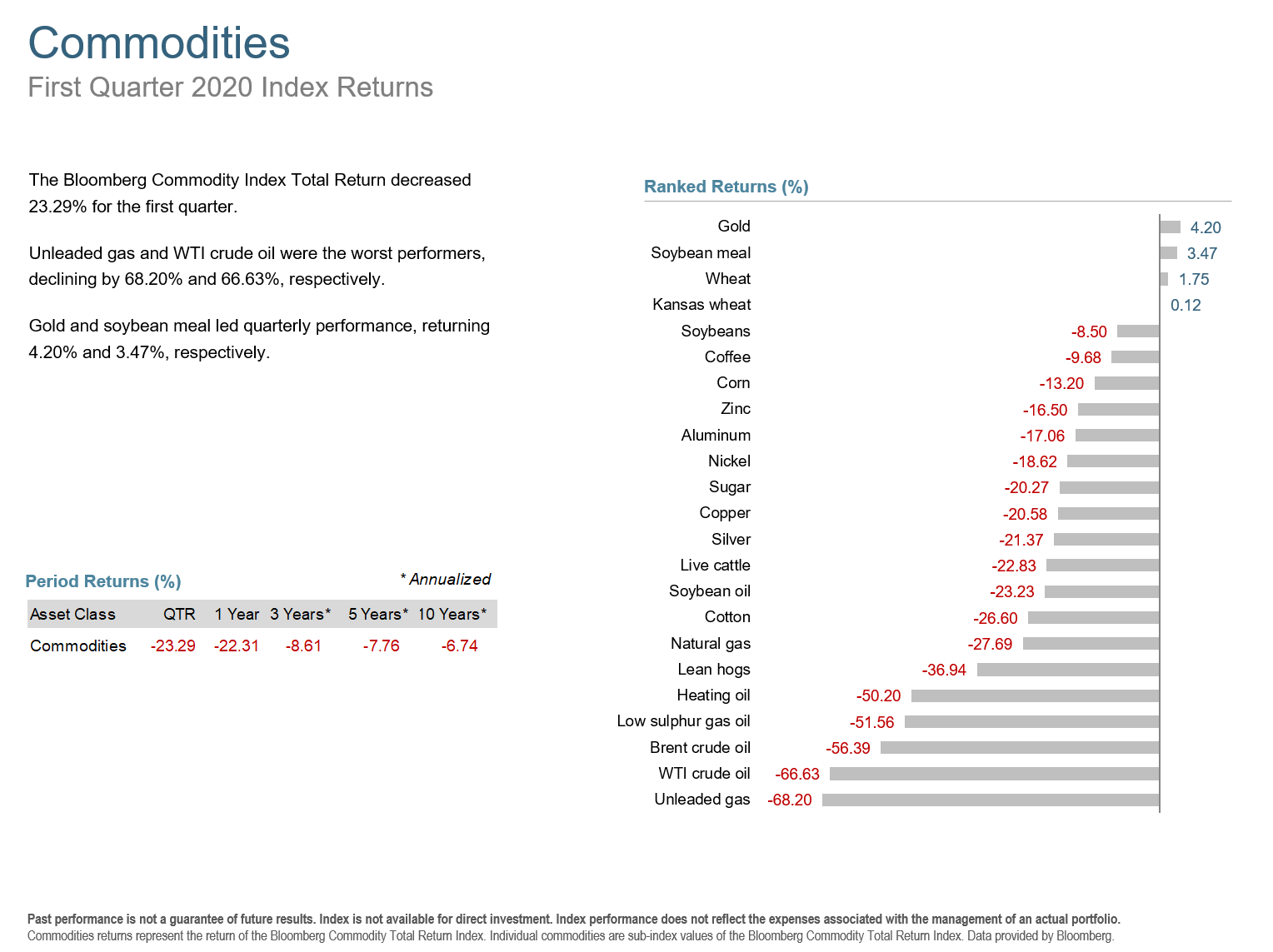

Commodities also fell with the Bloomberg Commodity Index Total Return dropping 23.29% in the quarter. Gold and Soybean Meal led performance, returning 4.2% and 3.47%, respectively. West Texas Intermediate Crude and Unleaded Gas were the worst performers, declining by 66.63% and 68.20%, respectively.

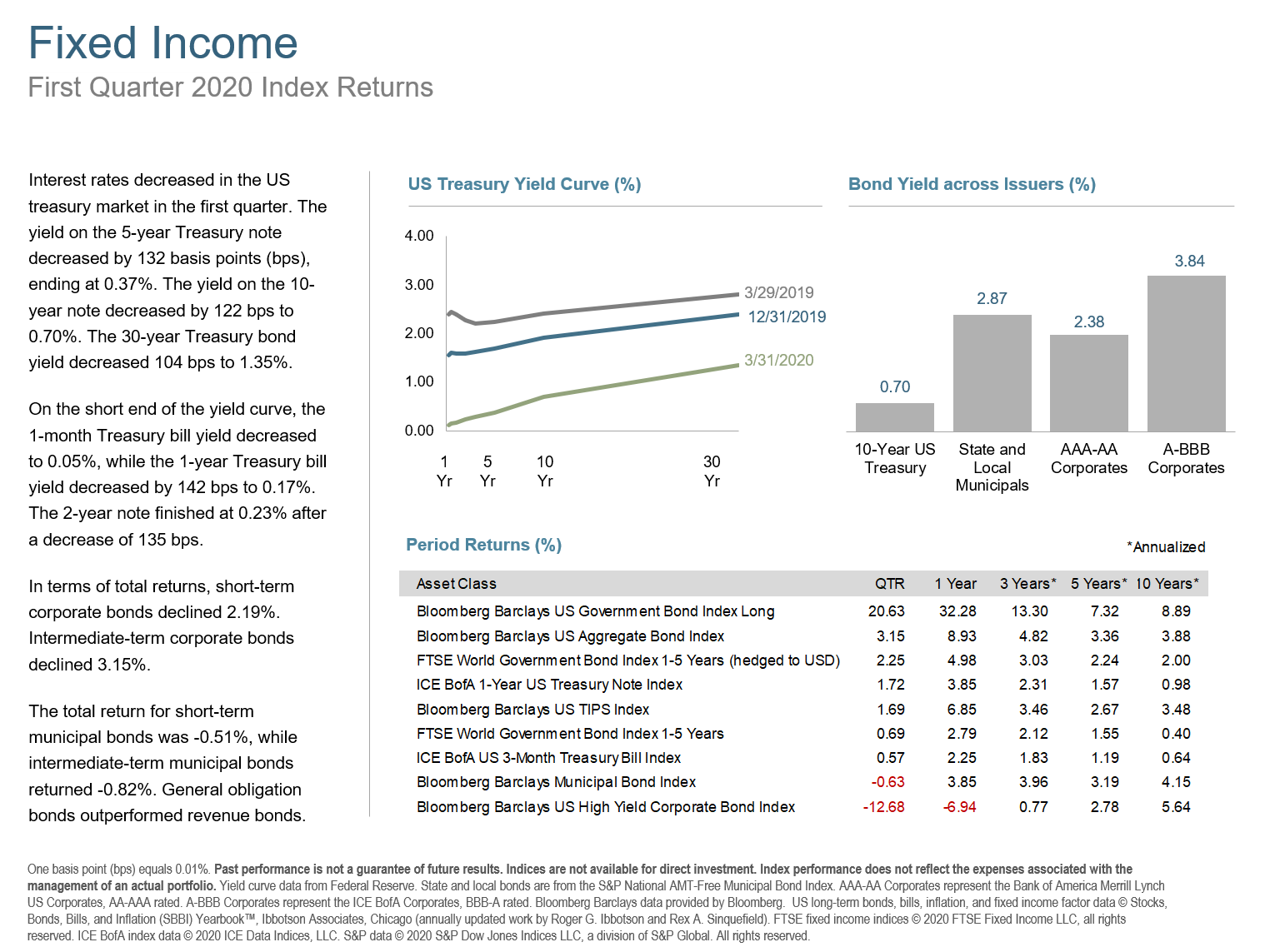

As investors fled for safe havens, interest rates dropped in the US Treasury market, with the the yield on the 5-year Treasury note decreasing by 132 basis points (bps), ending at 0.37%. The yield on the 10-year Treasury note fell by 122 bps to 0.7%. The 30-year Treasury bond yield decreased by 104 bps to finish at 1.35%.

On the short end of the curve, the 1-month Treasury bill yield decreased to 0.05%, while the 1-year T-bill yield fell to 0.17%, a 142 bps drop. The 2-year T-note yield finished at 0.23%, decreasing 135 bps.

In terms of total returns, short-term corporate bonds declined by 2.19% and intermediate-term corporate bonds rose by 3.15%. The total return for short-term municipal bonds was -0.51%, while intermediate munis returned -0.82. General obligation bonds outperformed revenue bonds.

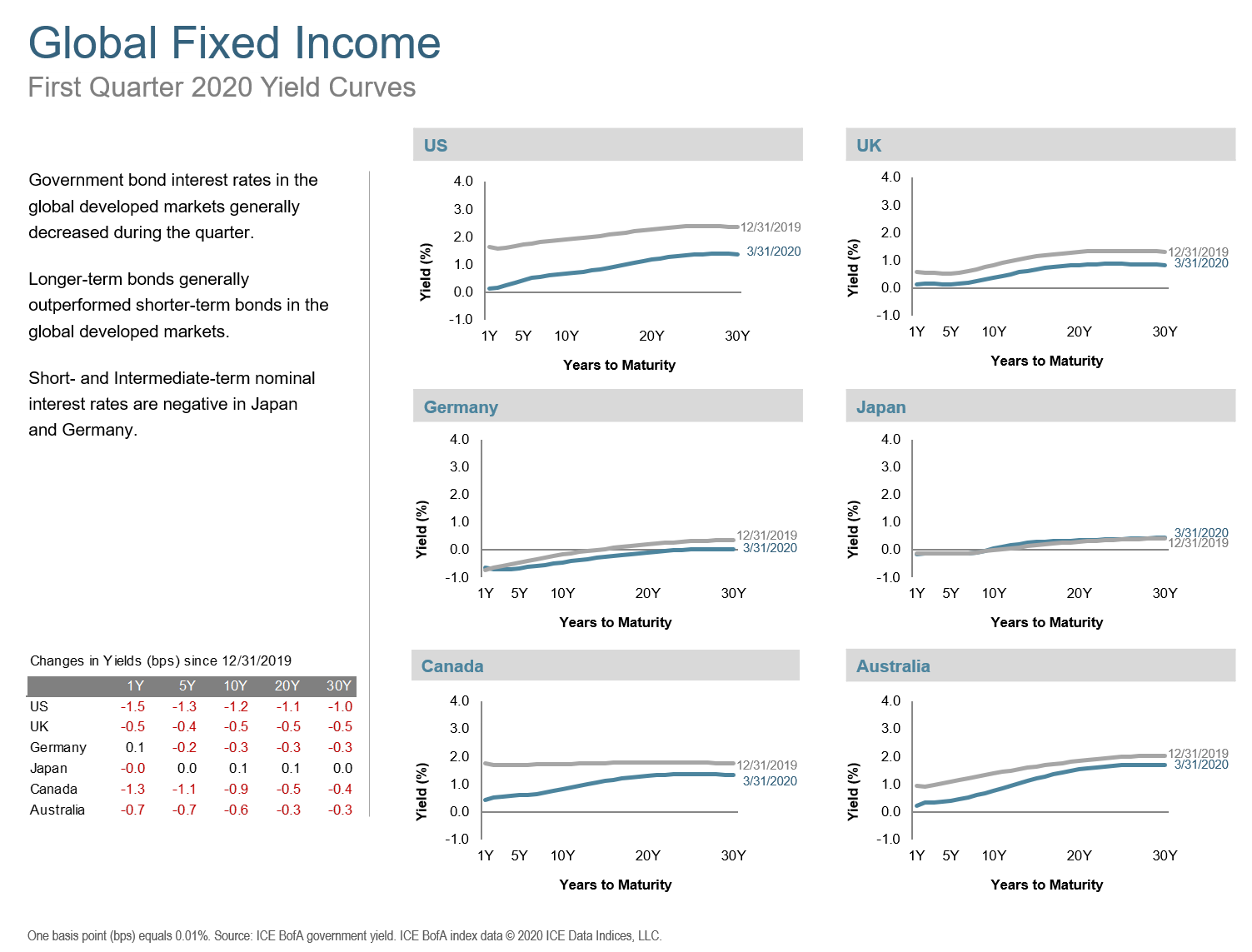

Interest rates in the global developed markets also decreased during the quarter. Longer-term bonds generally underperformed shorter-term bonds in those markets. Short- and intermediate-term nominal interest rates again were negative in Germany and Japan.

The Q1 2020 Market Review features world capital market performance and a timeline of events for the past quarter. It begins with a global overview, then features the returns of stock and bond asset classes in the US and international markets.

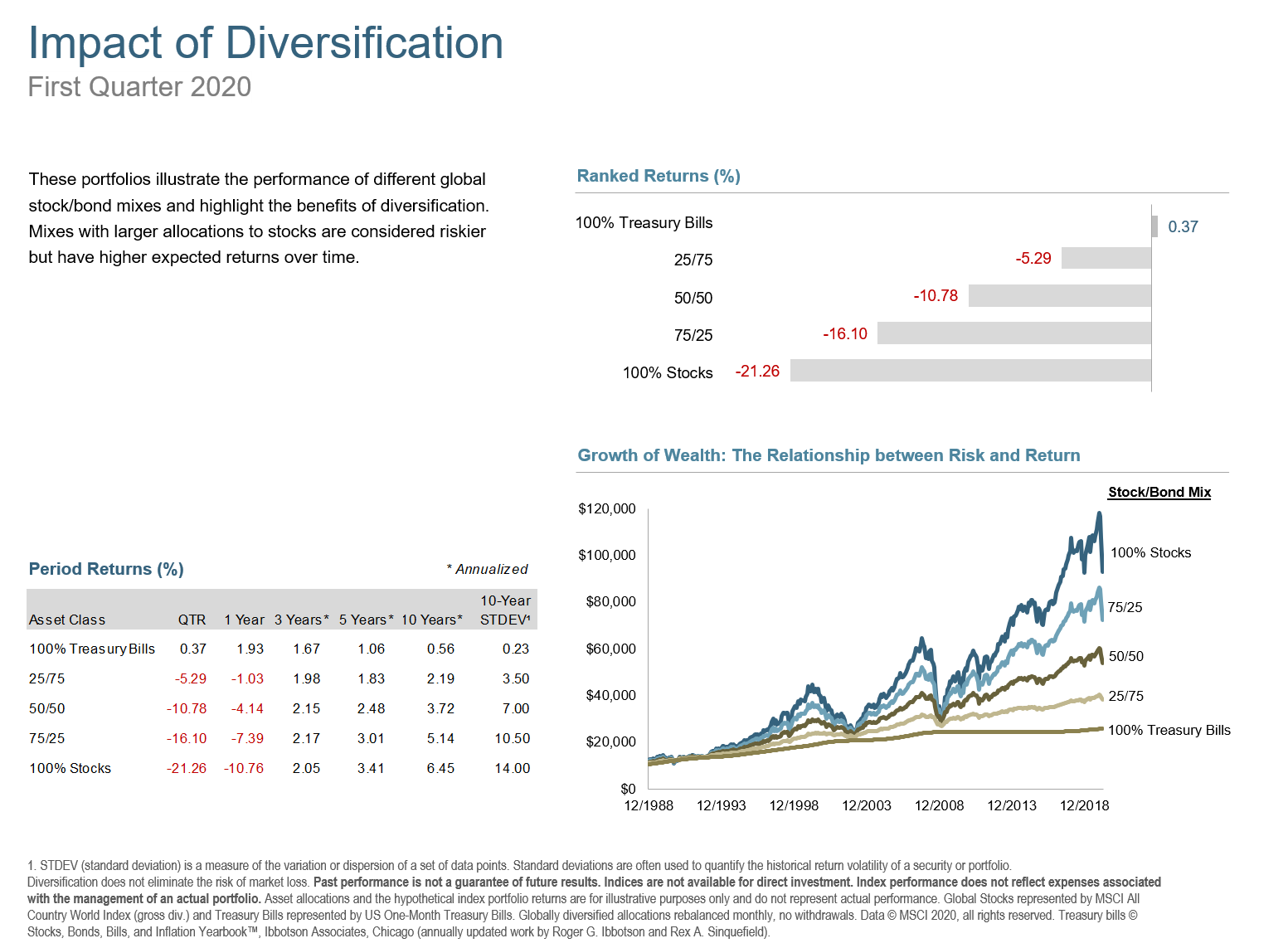

As with any market condition, a sound plan makes the ups and downs much more manageable. Get in touch if you would like to review your plan.