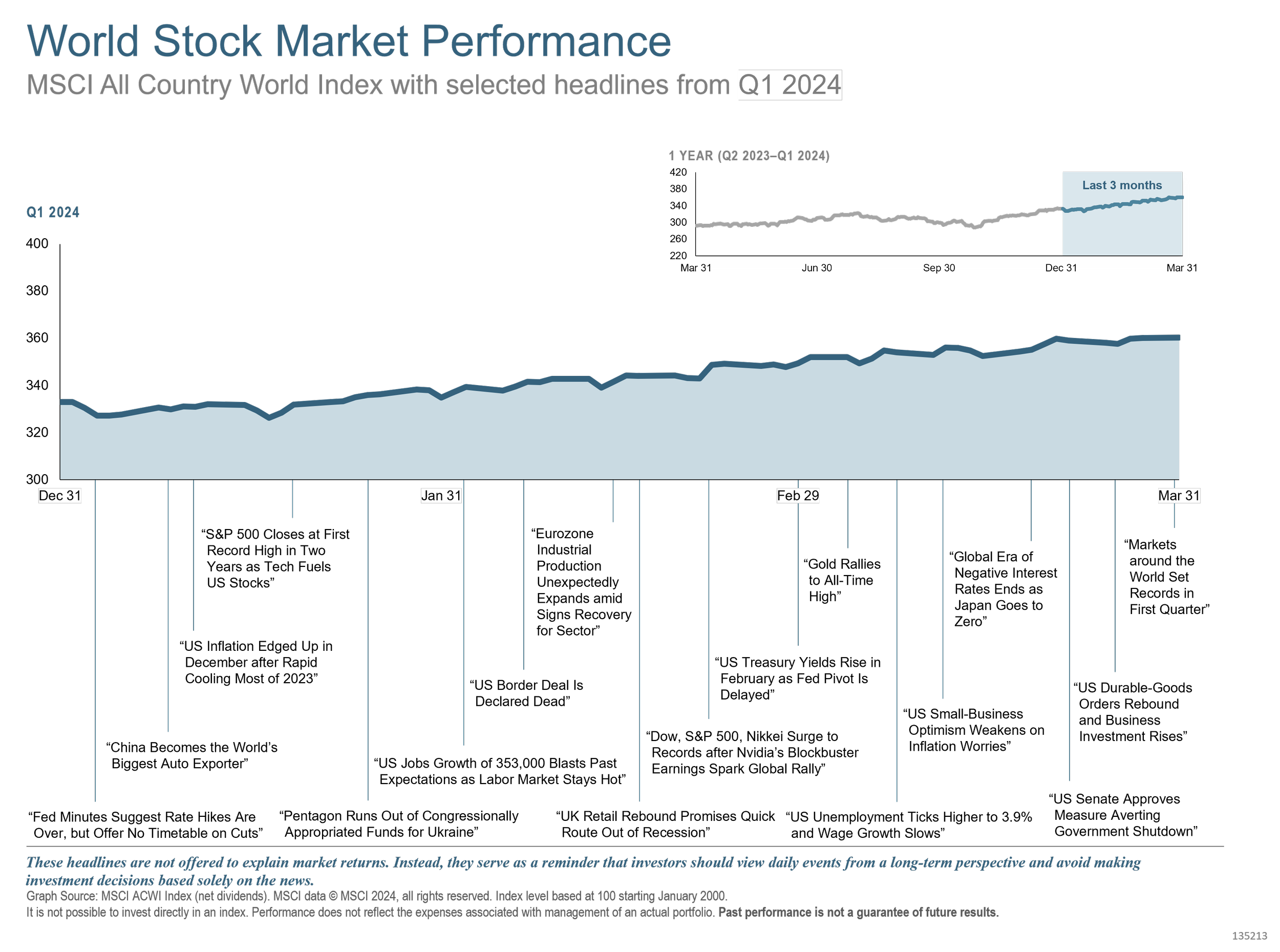

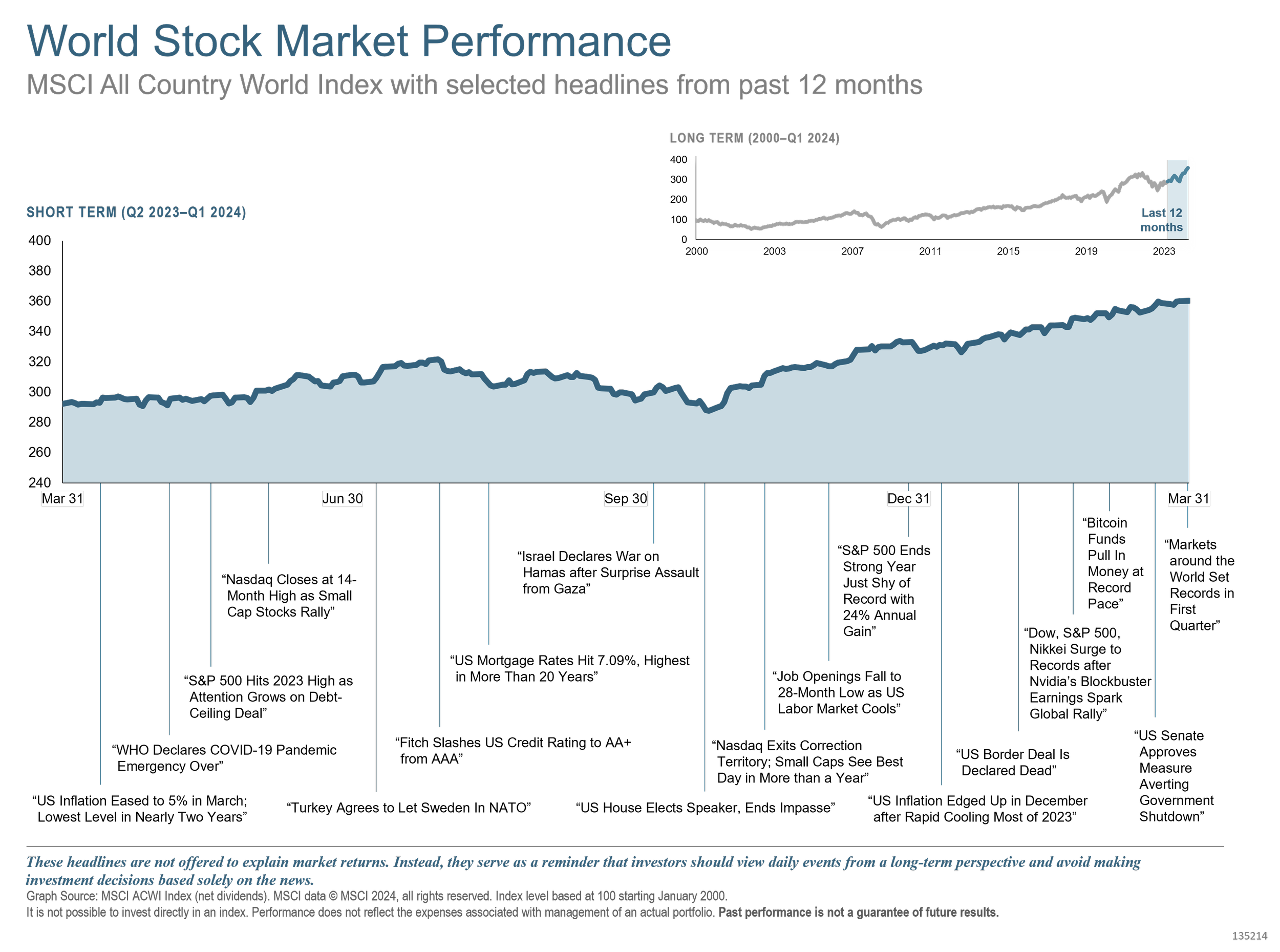

Global stock markets generated impressive returns in Q1. Particularly in the US, markets were propelled higher by the anticipation of an AI-driven productivity surge, which surpassed concerns regarding higher interest rates and the uncertainty created by the upcoming US elections.

For the first time since my senior year of college (1989), the Nikkei Index of Japan struck new highs. Further, the Russell 3000 and S&P 500 Index, among other main US indices, ended the quarter at record high levels.

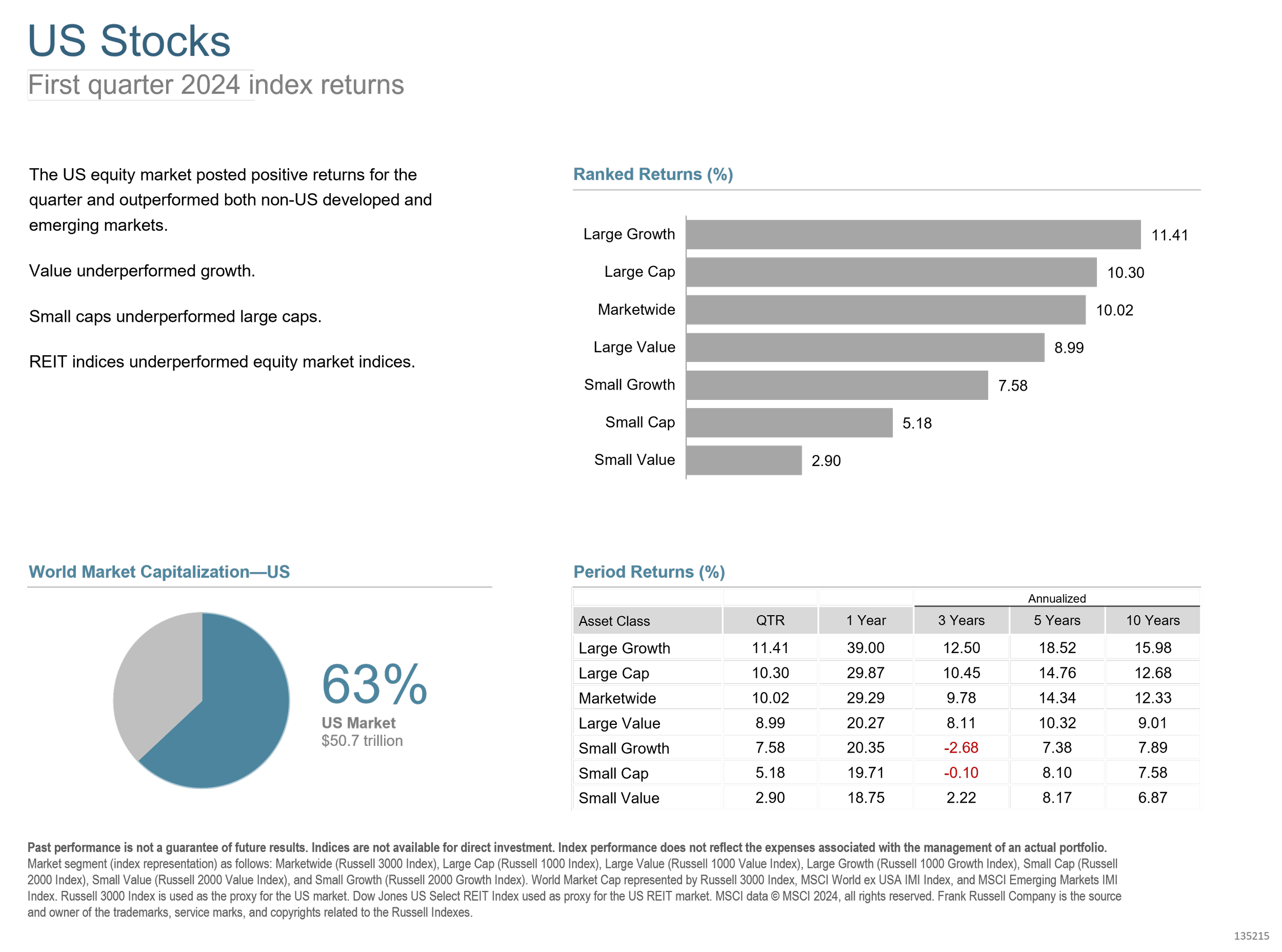

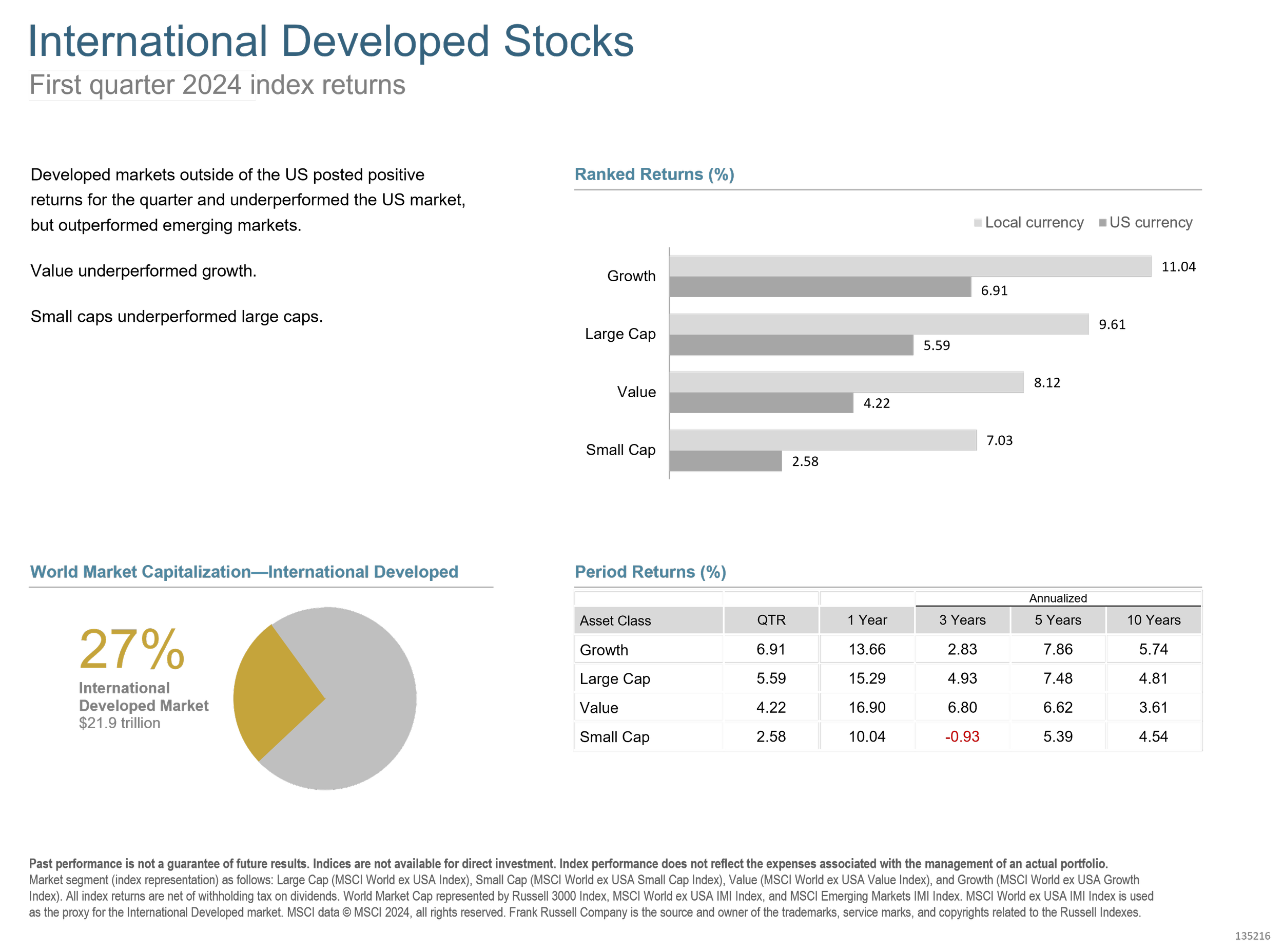

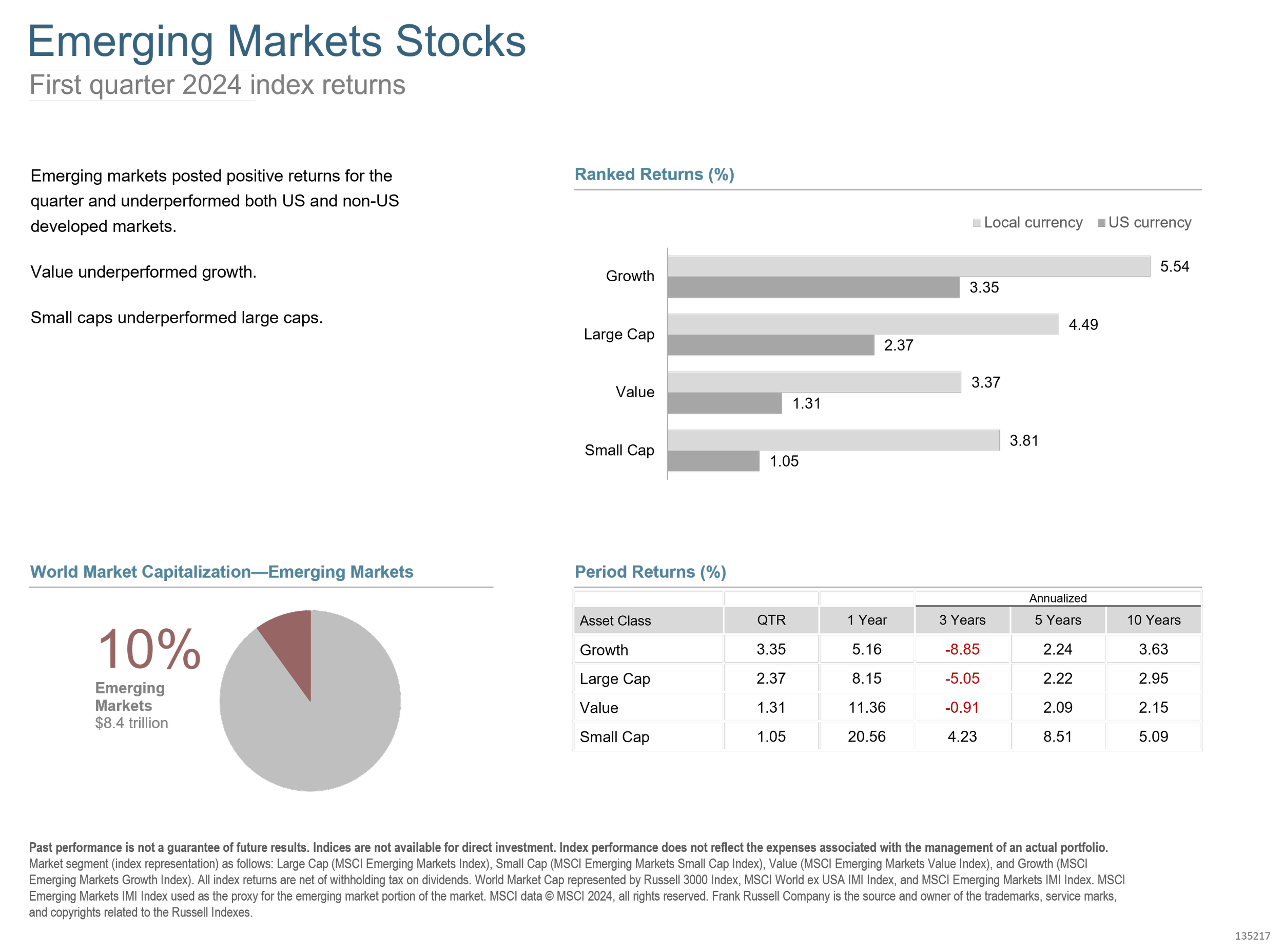

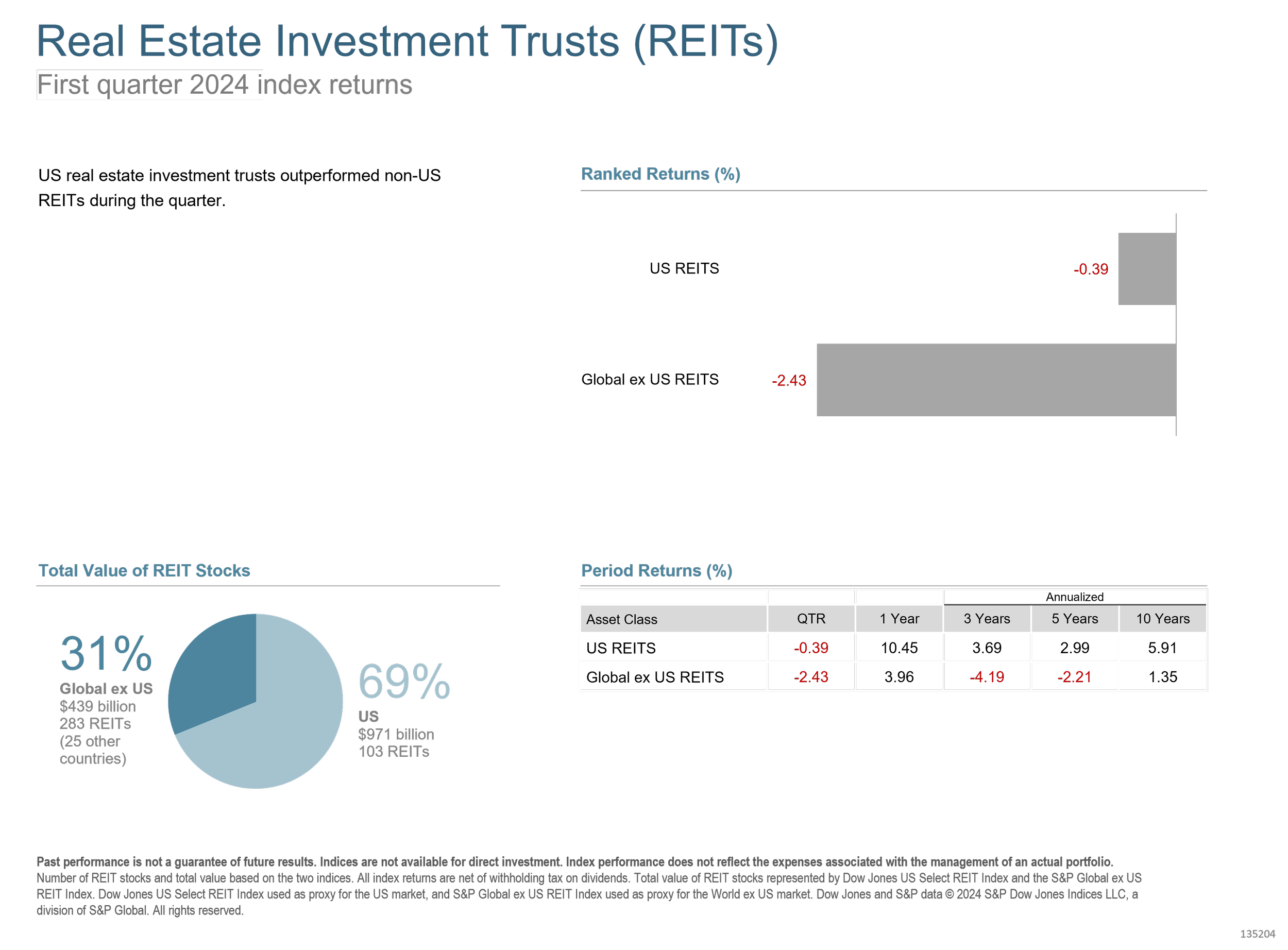

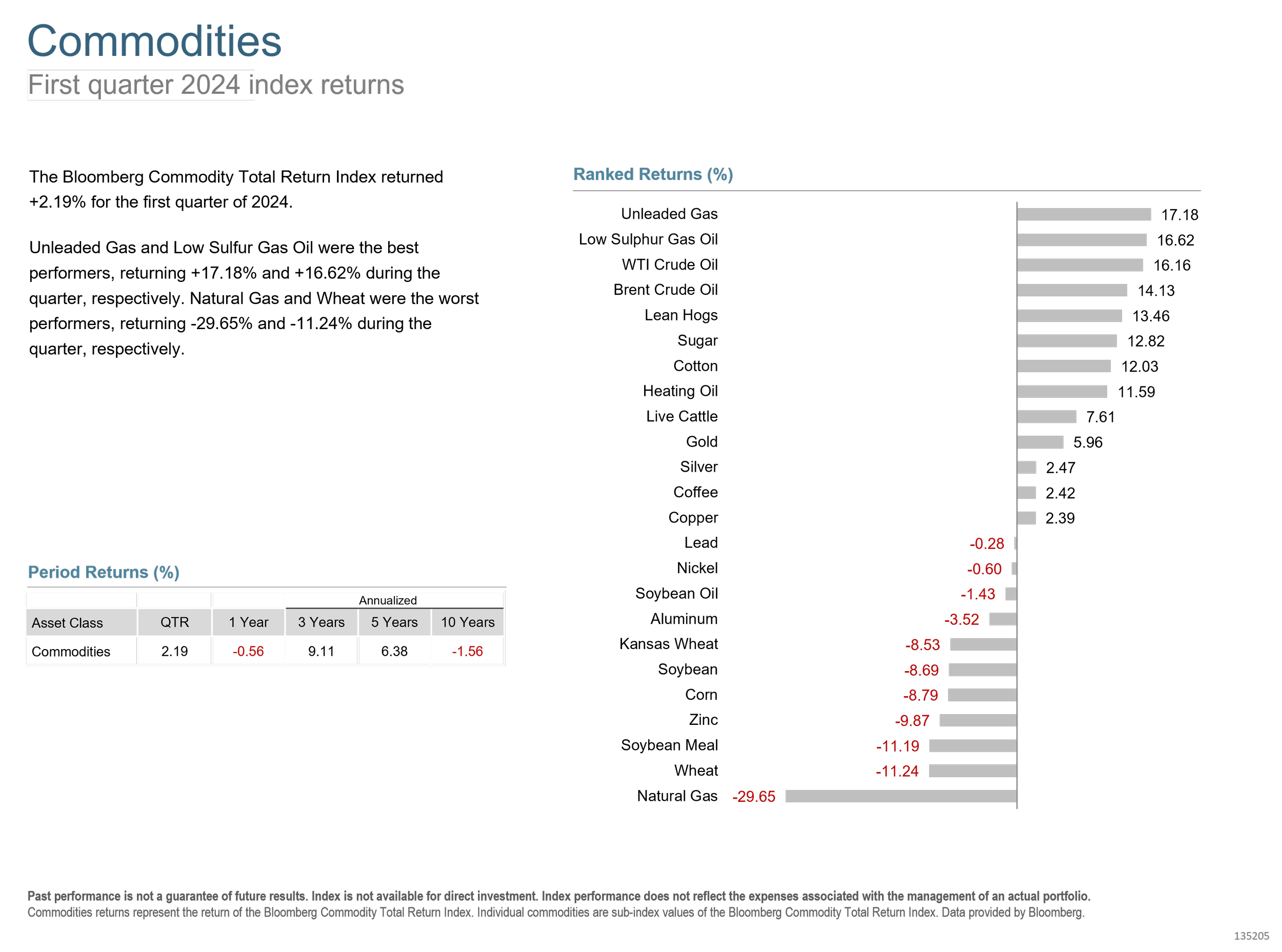

Energy and Communication Services stocks led the US charge, with gains coming from a broader group of stocks than the "Magnificent 7" companies that dominated the US market last year. In fact, some of those stocks (Apple and Tesla) fell during the quarter. Following a robust Q4, REITs were the only negative-performing sector. As for the factors we emphasize for higher expected returns, value stocks and small caps underperformed. However, the profitability factor (stocks that are profitable) offered higher returns.

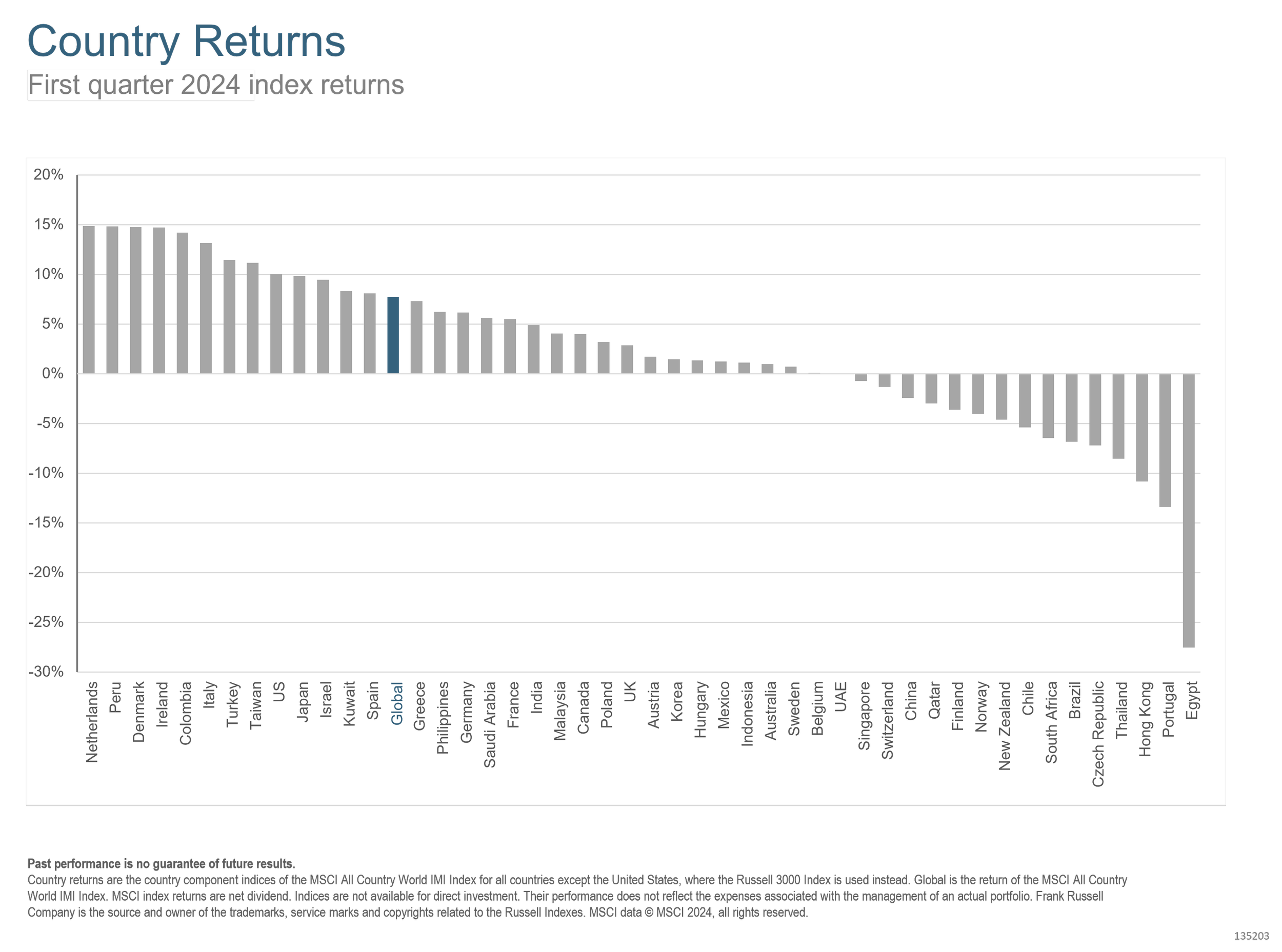

While the US market was strong, the Netherlands, Peru, Denmark, Ireland, Columbia, Italy, Turkey, and Taiwan all had better returns. The lesson for investors from this quarter is that diversification is still important.

History is full of examples of today’s winners becoming tomorrow’s afterthoughts. In fact, investors are likely to lose money on most companies. If we look back over the last century, we can see that nearly all wealth creation in the stock market came from less than 2000 individual stocks. That may sound like a lot until you realize that there were over 28,000 individual companies to choose from in the US stock markets between 1926 and 2022.

The hard part is trying to discern the Apples from the Blackberrys. One approach is to correctly guess which companies will outpace the market, get the timing right, and have the fortitude to stick with it when times are tough. The other is to buy the entire market and be confident that you will participate in the success of all of the winners. You can probably guess which approach we favor.

If you have concerns about whether you are winning or not, get in touch to review your plan and portfolio. In the meantime, you can see the slides below for a visual review of Q1 2024.