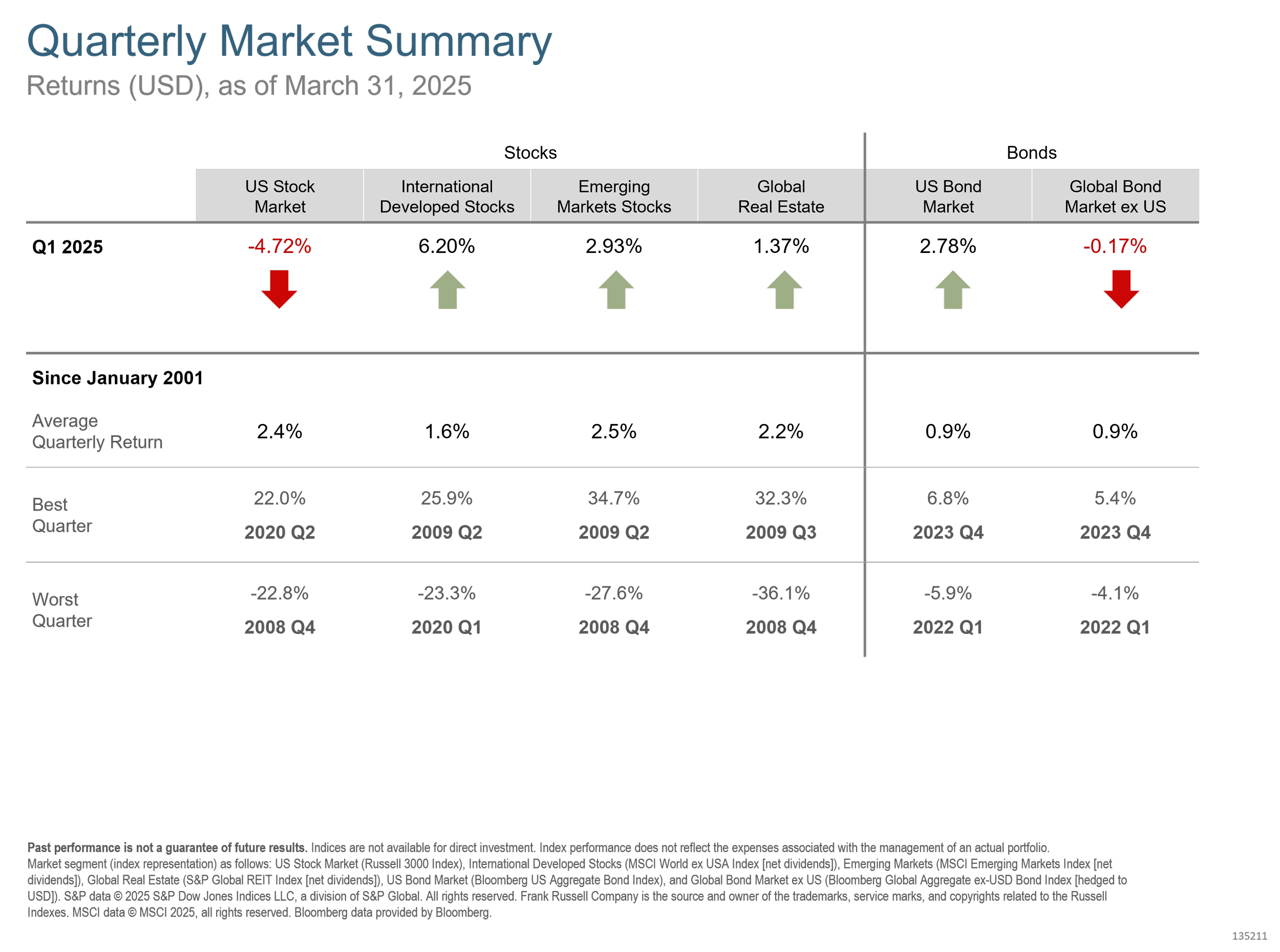

For Q1 2025, US stocks experienced a notable decline, with the Russell 3000 Index down 4.72%. This contrasted sharply with international developed markets, which rose by 6.20%, and emerging markets, which gained 2.93%. Global real estate exhibited moderate growth, up 1.37%. Bonds were similarly mixed, as US bonds increased 2.78%, while global bonds outside the US showed slight weakness, declining by 0.17%.

Trade policy gained prominence as the Trump administration's proposed tariffs sparked global market uncertainty. Interestingly, primary tariff-targeted markets such as Canada, Mexico, and China posted positive stock market returns, echoing patterns from Trump's previous term where contentious trade discussions did not consistently depress target-country stock markets.

US Stocks

Within the US, equity returns were under pressure, largely driven by declines in technology and small-cap stocks. Notably, large value stocks provided positive returns of 2.14%, significantly outperforming large growth stocks, which fell by 9.97%. Small-cap stocks, particularly small growth, were the hardest-hit segment, down 11.12% for the quarter.

International and Emerging Markets

International developed markets provided investors with positive performance, led by value stocks rising 4.32%. Small-cap stocks in these markets, however, struggled, declining by 5.49%. Emerging markets displayed resilience with value stocks showing the strongest gains, further affirming the global preference for value during the quarter.

Commodities and Real Estate

Commodities surged 8.88%, with natural gas (+30.01%) and copper (+23.82%) leading the charge. Conversely, agricultural commodities such as soybean meal and zinc experienced declines. Global real estate investment trusts (REITs) showed steady growth, outperforming US REITs, reflecting ongoing strength in international property markets.

Fixed Income

Interest rates in the US generally declined, boosting bond returns. The Bloomberg US Aggregate Bond Index rose by 2.78% as investors sought safety amidst equity market volatility. Shorter-duration bonds delivered consistent positive returns, while municipal bonds lagged slightly.

Alternative Investments

In the first quarter of 2025, alternative investment funds demonstrated resilience and provided positive returns amidst broader market volatility, highlighting their value in diversified portfolios. Below are three alternative funds we use in some portfolios.

AQR Style Premia Alternative Fund (QSPIX)

QSPIX posted a gain of 10.74% for Q1 2025. The fund employs a diversified, long-short strategy across various asset classes, aiming to exploit style premia such as value, momentum, carry, and defensive factors. This strategy is designed to generate returns uncorrelated with traditional market movements, enhancing portfolio diversification.

Stone Ridge Diversified Alternatives Fund (SRDAX)

SRDAX modestly advanced by 0.56% in Q1 2025. The fund invests primarily in alternative risk premiums and seeks to provide investors with consistent returns through exposure to reinsurance, variance risk premiums, and alternative lending markets. Its strategy offers diversification away from traditional stock and bond portfolios.

Cascade Private Capital Fund (CPEFX)

CPEFX recorded a 3.14% return during the first quarter of 2025. This fund focuses on private equity investments, offering exposure to privately held companies through direct investments, co-investments, and fund commitments. CPEFX invests in opportunities outside the public markets.

Looking Ahead

Markets remain attentive to ongoing developments around global trade policies and their broader economic implications. The divergence between US market performance and international equities underscores the importance of a globally diversified portfolio to navigate these volatile conditions.

The coming months may be more uncertain than the recent past as the current administration attempts to implement broad tariffs and assertive trade policies, suggesting a renewed focus on reshaping the global economic order. These measures, including a global 25% tariff on steel and aluminum, signal an attempt to realign trade balances, prioritize American industry, and renegotiate existing international agreements to favor U.S. interests.

The administration's “America First” policies reflect a broader strategy to assert U.S. economic and geopolitical dominance, aiming to shift traditional alliances and trade relationships. By taking a more unilateral stance on international trade, the administration is implicitly challenging existing frameworks like the WTO and traditional multinational agreements.

While the intent appears clear—prioritizing U.S. interests and economic nationalism—the ultimate outcome of these actions remains unclear. Whether this approach will sustainably benefit the U.S. economy or disrupt global stability depends heavily on the reactions and countermeasures from other economic powers such as China, the EU, and neighboring countries like Canada and Mexico.

All of this uncertainty is likely to result in increased volatility in the market. However, we must accept volatility as a feature of markets in exchange for higher returns compared to safer alternatives. If your goals are long-term, periods such as this may present opportunities to enter markets while they are “on sale.” If your goals are shorter or if you are taking income from your portfolio, it may be helpful to get in touch to review if the recent market jitters have materially impacted the likelihood of your financial plan being successful.

If you need to review your portfolio or financial plan, get in touch.